ASX Small Caps Lunch Wrap: Who thought tripping balls was the way to write a speech this week?

News

News

Local markets were making ground again today, with all sectors in the green and technology and the goldies leading the charge, following on from another happy session on Wall Street overnight.

It’s also the first Tuesday of the Month, and you know what that means… the RBA is finishing up its two-day lunch-a-thon and the board members are set to emerge, engorged and satiated for another month, to announce that they’ve decided to leave interest rates on hold.

Probably because the breakfast burritos had congealed, or the gazpacho was “too cold” yesterday. But also probably because inflation is still not under control here (or anywhere else, for that matter) so its best we just leave the nation’s thumbs in the interest rate thumbscrews for at least four more weeks.

Until we learn.

I’ll get into the details of what’s happening on the market, but first, there’s been an alarming admission from a fella who had been hand-picked to be the guest speaker at the Ohio State University’s spring commencement ceremony, to address a cohort of students graduating from the college.

Days before he was due to speak, Chris Pan – for some inexplicable reason – took to LinkedIn to publicly announce that he’d been having trouble writing his speech, and had turned to external sources to get some assistance finishing the first couple of drafts.

Pan wrote that he’d “tried ChatGPT but wasn’t that good”, so instead turned to a different kind of “AI” – Ayahuasca Intelligence – before turning up to talk in front of 60,000 graduating students and their families.

Ayahuasca is, for those not in the know, a potent hallucinogenic drug used traditionally by South American healers, and recreationally by North American psychonauts.

The result was a rambling speech in which Pan widely mocked the generation of students he was addressing for their lack of courage when it came to investing, telling the students that, among other things, they should be spending their spare time buying up cryptocurrencies as a side hustle to get rich.

There was reportedly some other hippie-dippie nonsense in the speech about resilience, with Pan telling students: “We cannot learn forgiveness if no one has wronged us, compassion without suffering, and resilience without setbacks. We cannot learn tolerance without differing perspectives.”

Whether he was talking about life in general, or the fact that crypto still has a terrible image problem because of the number of high-profile crypto bros currently sitting in prison for breaking countless laws on their way to “earning” equally countless millions, is still up for debate.

The ASX is waiting breathlessly for 2:30pm to see what the RBA board is going to do about interest rates today, but that hasn’t stopped investors from rolling up their sleeves and getting on with making it a happy, profitable place to be this morning.

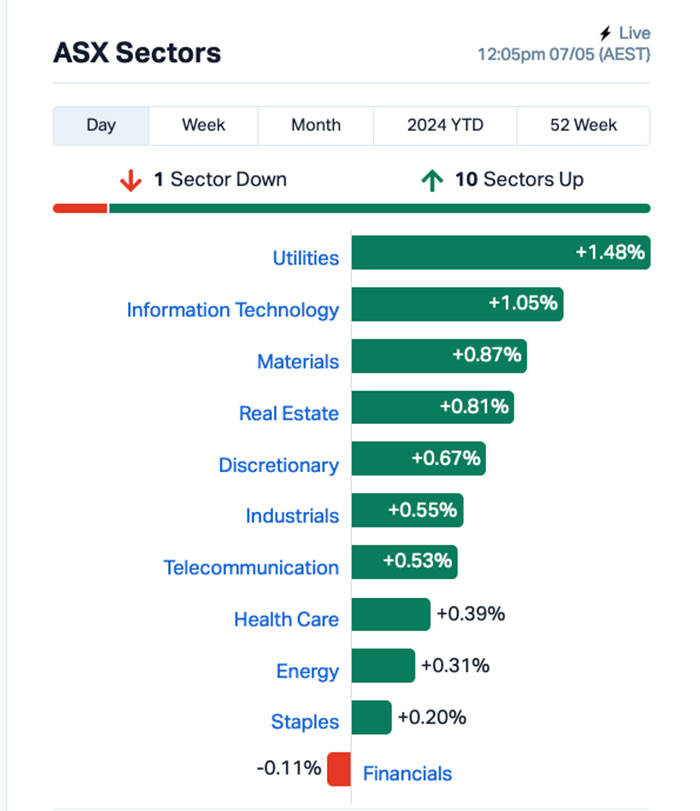

All the sectors were in the green until shortly before midday, when Financials sank below the waterline, weighed down by the banks. Around 12:00pm, the sectors looked like this:

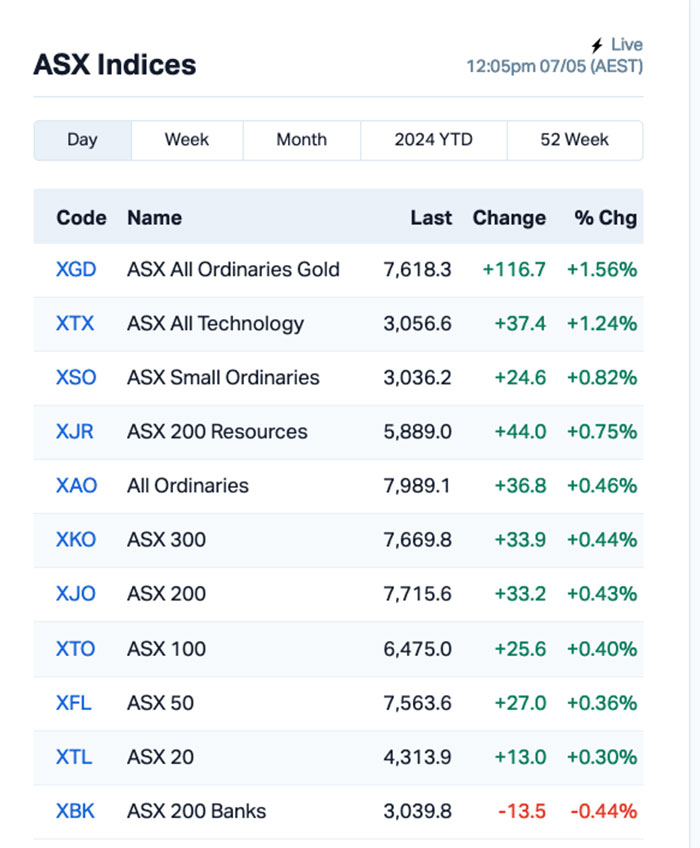

And the reason for Financials falling behind the rest of the class came from the banks, which had a cracker of a day yesterday but obviously investors felt the need to flee, leaving that sliver of the market down -0.44% by the middle of the day.

Actually… a closer look shows that the banks have been whipsawing around quite sharply all morning – my bad, I don’t usually pay a whole lot of attention to them, as they’re generally well beyond my Small Caps purview.

But this is what the XBK ASX 200 Banks index has been doing this morning, and it looks more like someone’s attached electrodes to the scrotum of a frog and charted that instead of the normally quite moderate banking sector.

The main culprit seems to be National Australia Bank (ASX:NAB), which lurched more than 2.6% in the wrong direction this morning for no apparent reason, and Australia and New Zealand Banking Group (ASX:ANZ) which dropped nearly -0.8% after revealing a -4% profit slump for the six months to March 2024, and a -7% net interest income drop over the previous 12 months to March.

Also making news this morning is a massive and ongoing service outage that has knocked all services for UniSuper members offline for nearly a week, with only a very tentative “maybe on 09 May” date for things to get back to normal.

UniSuper has been telling its members that it’s a problem with Google Cloud that is causing the problem, but I can tell you that at least one UniSuper customer is outraged – outraged, I tell you – that it’s taking so long to fix the problem.

I spoke to myself about the issue this morning, and I can report that I said that I am more than a little concerned that a problem with Google Cloud that doesn’t appear to be affecting anyone else is being blamed for the issue… because that suggests that there’s possibly a bit of blame shifting going on.

“I am outraged… but I’m staying calm and not panicking about the security of my Super account, because boy, you’re looking great today,” I told myself in the bathroom this morning.

I have since, however, been informed that I was lying to myself and I do, in fact, look like I’ve been locked in the back of a hot car for more than a week – and now I don’t know what to believe.

Wall Street’s bull run has continued overnight, with at least 19 people hospitalised, two rogue animals euthanised and the city elders of Pamplona threatening renewed legal action.

Earlybird Eddy stayed up all night to bring us the news that the S&P 500 rose by +1.03%, the blue chips Dow Jones index was up by +0.46%, and the tech-heavy Nasdaq surged ahead by +1.19%.

There was a lot of talk from US Fed representatives overnight, including Thomas Barkin from the Fed Bank of Richmond who reckons keeping rates high will ease the economy and bring down inflation to the 2% mark. He adds that the current Fed rate, which has been at 5.25% to 5.5% since July, is enough to do the job.

John Williams from New York’s Fed said rate cuts are in the cards eventually, but the timing hinges on all the data together – which is a pretty canny observation from the guy who wrote the music for Star Wars. Or was it Hey True Blue?

To US stock news, and Boeing took a dip of around -1% after the Federal Aviation Administration said it was looking into Boeing’s 787 Dreamliner again.

This comes after Boeing told them last month that it “might have missed some inspections”, which is (pardon my French) genuinely f@%king terrifying, especially coming from a company that builds high-speed airborne tubes that have precisely zero business being in the air in the first place.

Micron Tech and Nvidia were among the big winners on the Nasdaq 100, scoring gains of +4.7% and +3.77% respectively.

About 80% of the companies in the S&P 500 have now released their quarterly reports.

According to FactSet, the benchmark index is on track for a 5% boost in Q1 earnings per share. That’s the largest jump since Q2 of 2022, even higher than the 3.2% growth analysts had expected prior to the start of the earnings season.

Here are the best performing ASX small cap stocks for 07 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap OAR OAR Resources Ltd 0.002 100% 586,469 $3,153,311 CHK Cohiba Minerals 0.004 33% 5,795,012 $10,764,733 ODE Odessa Minerals Ltd 0.004 33% 1,895,971 $3,129,848 M4M Macro Metals Limited 0.0275 31% 25,667,646 $67,873,402 FGL Frugl Group Limited 0.1 28% 193,384 $7,746,829 TGH Terragen 0.025 25% 200,000 $7,381,623 1AG Alterra Limited 0.005 25% 34,050 $3,448,586 ADY Admiralty Resources. 0.01 25% 2,003,710 $13,035,792 CCO The Calmer Co Int 0.005 25% 5,130,985 $5,443,519 ME1 Melodiol Global Health 0.0025 25% 378,774 $1,426,974 TEM Tempest Minerals 0.01 25% 745,520 $4,152,995 ICE Icetana Limited 0.03 20% 979,121 $6,615,711 ANX Anax Metals Ltd 0.048 20% 21,578,804 $23,652,684 BLZ Blaze Minerals Ltd 0.006 20% 386,069 $3,142,791 HXL Hexima 0.012 20% 90,000 $1,670,396 PRX Prodigy Gold NL 0.003 20% 75,000 $5,034,435 WSR Westar Resources 0.013 18% 38,781,230 $2,548,666 NME Nex Metals Exploration 0.02 18% 41,278 $5,993,053 AEV Avenira Limited 0.007 17% 230,115 $14,094,204 LPD Lepidico Ltd 0.0035 17% 633,705 $22,914,924 CHW Chilwa Minerals 0.635 15% 238,012 $25,231,251 BML Boab Metals Ltd 0.115 15% 26,860 $18,346,277 TTT Titomic Limited 0.071 15% 5,214,769 $62,659,423 GMN Gold Mountain Ltd 0.004 14% 103,045 $10,414,270 BEO Beonic Ltd 0.026 13% 251,171 $9,763,384

The winners table on Tuesday morning has been dominated by diggers and explorers without a lot of news to back it up, other than some fairly hefty moves among certain commodities over the past week or so.

That includes a 7.1% spike in iron ore prices this week, +3.86% jump for silver for the week and some sharp movements among the lesser-watched metals, such as manganese (+28.1% for the month) and Indium, which is flying at +32% for the month, and +78.9% for the year.

That partially explains why some of the market minnows are moving independent of outright news, such as one of Tuesday morning’s better performers, Cohiba Minerals (ASX:CHK), although it did announce yesterday that a strategic review of the Olympic Domain project, which the company says “adjoins one of the biggest IOCG discoveries”, has “confirmed strong prospectivity for IOCG mineralisation which warrants further investigation”.

It also partially explains why Macro Metals (ASX:M4M), which owns 100% of the Agbaja Iron and Steel project located in Kogi State in the Republic of Nigeria, was on the move again today, despite no news today.

One company with news was Westar Resources (ASX:WSR), climbing on Tuesday after delivering some great finds from the Mindoolah Mining Centre, where stockpile grab samples have returned assays up to 40.7g/t Au and 214g/t Ag, with other samples testing at 13.6, 12.3, 9.4, 6.9, 5.8g/t Au.

The company is also reporting a 1.7g/t Au and 16.1g/t Ag rock chip sample from quartz vein in the Mindoolah Main Reef open pit, and says that a systematic stockpile and open pit sampling program is planned for the site.

Antilles Gold (ASX:AAU) was moving on news that results of the Scoping Study for the first stage of the proposed Nueva Sabana gold-copper mine in Cuba are in, showing that the deposit has a small 3g/t gold cap, an underlying copper-gold zone, and a deeper sulphide copper zone that is open at depth at 150m, and could potentially transition into the El Pilar porphyry copper deposit which is offset to the south.

Brazilian Critical Minerals (ASX:BCM) was up after announcing “outstanding magnetic REO (Nd, Pr, Dy, Tb) recoveries” averaging 68% overall, with world class recoveries averaging 69% NdPr and 48% DyTb from a bulk sample analysed at ANSTO1 confirmed at the company’s Ema rare earth project.

And Titomic (ASX:TTT) has announced that it has completed the strategic sale of a custom Titomic Kinetic Fusion System (TKF System) to US-based Triton Systems, which counts as one of its lead consumers as the US Homeland Security sector, among other far less spooky applications for its tech.

Here are the most-worst performing ASX small cap stocks for 07 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap APC Aust Potash Ltd 0.001 -75% 174,158,483 $16,000,758 AXP AXP Energy Ltd 0.001 -50% 770,611 $11,649,361 EDE Eden Innovations 0.001 -50% 570,492 $7,356,542 JAV Javelin Minerals Ltd 0.001 -33% 6,947 $3,264,346 MRD Mount Ridley Mines 0.001 -33% 1,000,000 $11,677,324 PUA Peak Minerals Ltd 0.002 -33% 1,711,000 $3,124,130 VPR Volt Power Group 0.001 -33% 720,000 $16,074,312 IEC Intra Energy Corp 0.0015 -25% 4,491,000 $3,381,563 TX3 Trinex Minerals Ltd 0.003 -25% 2,172,510 $6,979,637 H2G Greenhy2 Limited 0.008 -20% 12,000 $4,187,558 ROG Red Sky Energy 0.004 -20% 257,006 $27,111,136 SAN Sagalio Energy Ltd 0.004 -20% 52,000 $1,023,301 SHO Sportshero Ltd 0.004 -20% 6,945,283 $3,089,164 VML Vital Metals Limited 0.004 -20% 17,293,067 $29,475,335 SNS Sensen Networks Ltd 0.022 -19% 646,140 $20,914,296 AFA ASF Group Limited 0.04 -18% 16,000 $38,827,479 BCK Brockman Mining Ltd 0.02 -17% 52,804 $222,725,571 GSM Golden State Mining 0.01 -17% 1,115,552 $3,352,448 IVX Invion Ltd 0.005 -17% 18,250 $38,547,193 NRZ Neurizer Ltd 0.0025 -17% 26,691,453 $4,959,538 MPR Mpower Group Limited 0.016 -16% 278,888 $6,530,362 OMX Orange Minerals 0.032 -16% 56,221 $3,258,507 EGY Energy Tech Ltd 0.035 -15% 681,560 $13,844,053 BCT Bluechiip Limited 0.006 -14% 150,000 $7,705,368 IMI Infinity Mining 0.06 -14% 17,500 $8,312,737

Prospect Resources (ASX:PSC) is progressing acquisition of the Mumbezhi copper project in Zambia with the issue of 8.3 million shares priced at 12c each and 6.25 million unlisted options exercisable at 15c and expiring on 11 April 2027 to Orpheus Uranium.

The company had initially reached the agreement in return for Orpheus withdrawing all legal claims to the exploration licence.

It also grants the company ownership of all existing mining and geological data over the project, which is now being processed, catalogued and analysed.

White Cliff Minerals (ASX:WCN) has been granted all federal licences for its Radium point uranium-copper-gold-silver project in Canada, which will allow it to proceed with its summer field season.

Initial work at Radium Point and Nunavut will include infield rock chip sampling, reconnaissance, and the airborne geophysical survey, which will then be followed maiden drilling.

The company has also completed exploration drilling at its Reedy South gold project in WA’s Cue Goldfields region to test for strike and depth-extensions to existing inferred resources of 42,400oz of gold.

Additionally, a geochemical campaign is nearing completion at the Lake Tay (Johnston) gold-lithium project and Diemals gold-copper-lithium-nickel project.

At Stockhead, we tell it like it is. While Prospect Resources and White Cliff Minerals are Stockhead advertisers, they did not sponsor this article.