You might be interested in

Mining

Monsters of Rock: Northern Star defends hedges as gold prices spike; Metals Acquisition bats off M&A talk

Mining

Gold Digger: Gold vs Bitcoin, analysts vs analysts – store of value narratives get in the ring

Mining

Mining

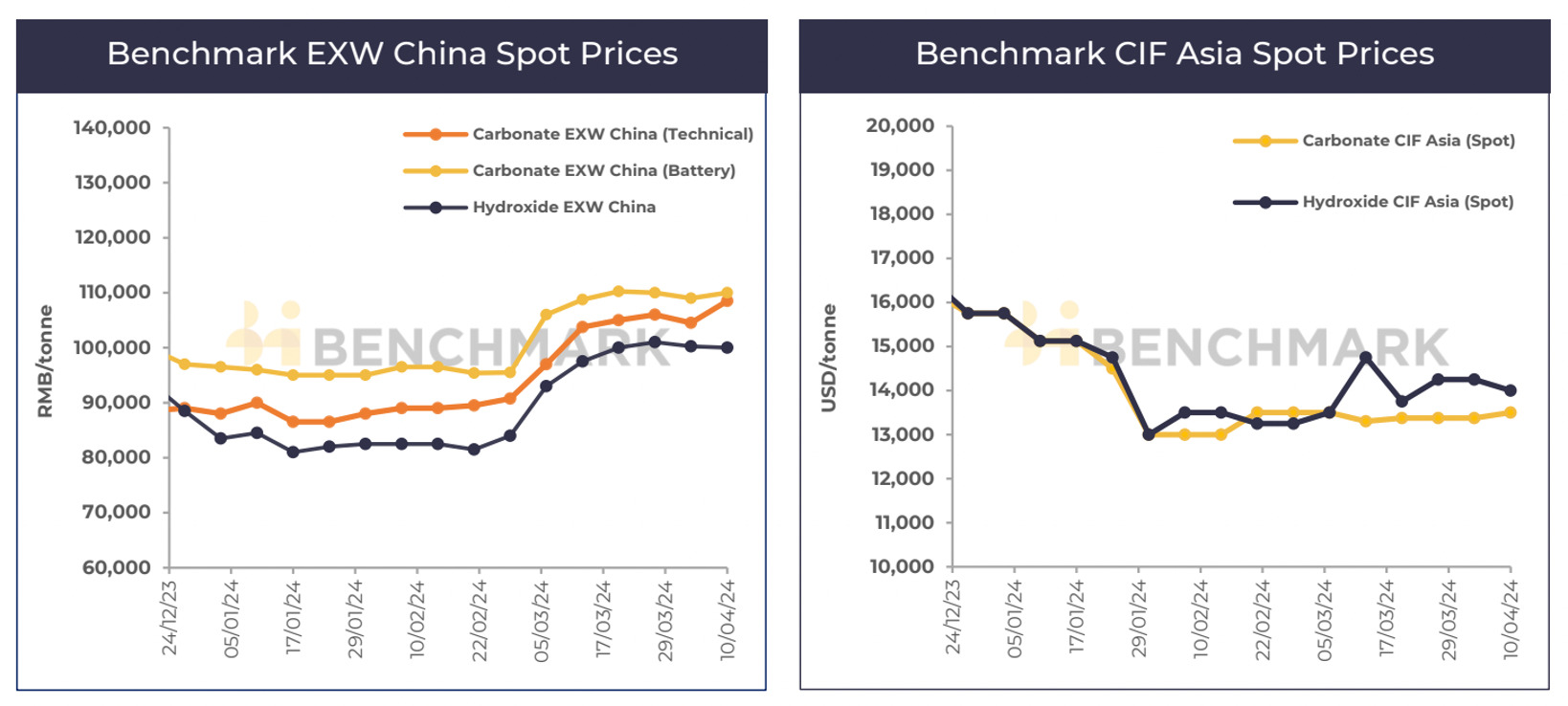

The nascent lithium price rebound continues, with prices for lithium carbonate in the Chinese domestic market rising in the week to 10 April as cathode producers increased their production estimates for April 2024.

“Benchmark received indications that several planned to increase production by as much as 20-30% in April versus March levels, boosting short term demand sentiment,” Benchmark Mineral Intelligence says.

Hydroxide prices were down marginally over the same period.

Promising news for the once high-flying Vulcan Energy (ASX:VUL), which today announced start of lithium chloride production from its Lithium Extraction Optimisation Plant (LEOP) in Landau, Germany.

It’s the culmination of over 3 years and more than 10,000 hours of successful in-house piloting testing, the company says.

It’s all going smoothly so far, with consistent early results of over 90% (up to 95%) lithium extraction efficiency. That’s right in line with expectations, VUL says.

LEOP, which cost €40m to build, is “an optimisation, operational training and product qualification testing facility”. The next step involves turning the lithium chloride (40% lithium) into battery grade hydroxide at the downstream plant, called CLEOP.

“Once CLEOP is in operation, which is expected in mid-2024, Vulcan will have produced the first fully integrated lithium battery chemicals in Europe, including conversion to a battery-grade chemical, with the co-production of renewable energy and heat,” VUL says.

“These optimisation plants are comparable to Vulcan’s Phase One, commercial plants, with similar process flowsheets, with the commercial project aiming for 24,000 tonnes per annum of lithium hydroxide production capacity, the financing process of which is currently being led by BNP Paribas.”

The project has an estimated €1,399m price tag.

To cornerstone the financing VUL is angling for up to €500m (~A$825m) from European Investment Bank, the lending arm of the European Union (EU) and one of the largest climate finance providers.

It also has a A$200 million (~€120 million) non-binding Letter of Support from Export Finance Australia (EFA), and “indication of strong ECA support” from Canada, Italy, and France.

Once Phase One commercial production kicks off VUL will aim to produce renewable energy and enough lithium for ~500,000 EVs from the Upper Rhine Valley Brine Field.

The $600m capped stock is up ~25% to $3.56/sh near close of play Thursday, for a year-to-date gain of 26%.

It is still down considerably from its September 2021 peak above $15/sh.

Escalating costs across the gold industry have hampered share prices, even as the gold price booms.

All in sustaining cost (AISC) is all the things mining companies pay to keep an operation running at steady state. It’s a decent measure how much profit or loss a miner is making at any given time.

Since FY19, Northern Star’s (ASX:NST) AISC has ballooned from $1,296/oz Aussie to newly revised guidance of $1,810-1860/oz in FY24 (up from A$1,730-1,790/oz previously).

That’s an increase of ~40%.

Meanwhile, the average Aussie gold price is up around 70% — if not more — over the same period, which sounds like a pretty good result to us.

The spot price is currently frothin’ at $3,590/oz, giving NST an outstanding margin even as “cost pressures remain prevalent across our sector”, it says.

NST remains on track to deliver its FY24 gold sold guidance of 1.6-1.75Moz (9 months to date: 1.18Moz) “based on positive momentum leading into an expected strong June quarter, driven predominantly by increased grade and mill utilisation rates”.

The $17.5bn capped miner is up ~11% year to date.

Listing on the ASX almost 17 years ago to the day, US based drilling company BLY leaves the bourse today after a private all cash takeover from American Industrial Partners took effect.

Shareholders pocketed US$1.9954/sh (A$3.06/sh), a 64% premium to the closing price on the ASX on 22 December 2023, the last trading day prior to BLY announcing the deal.

The 130 year old company is headquartered in Salt Lake City, Utah, and operates in 26 countries around the globe.

XMJ is now up 2.47% over the past week, and 6.6% over the past month.

It is easily the best performing sector on the ASX over that period, balancing out big falls in Info Technology (-5.3%) and Communications (-2.2%) stocks.

Pilbara Minerals (ASX:PLS) (lithium) +2.5%

Northern Star (ASX:NST) (gold) +2.4%

Gold Road Resources (ASX:GOR) (gold) +4.1%

Emerald Resources (ASX:EMR) (gold) +4%

Zimplats (ASX:ZIM) (platinum group elements) -3.2%

Regis Resources (ASX:RGL) (gold) -1.9%