CRI Enters Into Binding LOI to Acquire Black Raven Past-Producer Antimony-Gold Property, NL

/EIN News/ -- TORONTO, April 15, 2025 (GLOBE NEWSWIRE) -- Churchill Resources Inc. ("Churchill") is pleased to announce that it has entered into a binding letter of intent dated April 14, 2025 (the “LOI”) to acquire a 100% undivided interest in the Black Raven Antimony Property, located approximately 60 km northwest of Gander, Newfoundland and Labrador, from property owners Eddie and Roland Quinlan. The property encloses two small-scale past producing mines which operated between 1890 and 1918 exploiting stibnite, gold and arsenopyrite. These past producers and two related occurrences constitute gold, antimony, silver +/- copper, zinc and lead targets in veins and stockworks. The historical mines and other occurrences are located within close proximity to each other, in a larger-scale geological environment containing intense veining and alteration associated with felsic intrusions within a mafic volcanic domain.

Antimony is a critical element for the energy, transportation, and military industries with China, Russia, Tajikstan, and Burma generating over 90% of world production. Since China’s recent export ban (September 15, 2024), the price of antimony has increased roughly five-fold to >$50,000/tonne which is approximately 3x the current price of nickel. Churchill’s Taylor Brook Nickel-Copper-Cobalt-Vanadium-Titanium Property, and Florence Lake Nickel Property, are both in good standing for a number of years, such that further exploration and development can await improved market conditions sentiment while the Company focuses on high-grade antimony-gold and other critical minerals.

The Beaver Brook Antimony Mine owned by China Minmetals, and currently on care and maintenance due to declining resources, is located ~100 km south of Black Raven. It is reported that the owners are actively exploring for more deposits to feed the mill. (https://www.cbc.ca/news/canada/newfoundland-labrador/antimony-mine-closure-1.6703205)

The two past-producing mines, as well as the Taylors Room prospect and Western Head porphyry target, are described within the Government of Newfoundland’s Mineral Occurrence Data System (“MODS”), and in assessment reports, as summarized below:

Frost Cove Antimony Mine (MOD # 002E\10 SB001) –

- sporadic production between 1890-1918

- Two adits extend ~65m along Sb-Au veins, at 3m and 20m above sea-level and are still accessible

- Vein system/host felsic intrusion traced and sampled on surface for 800m

- Channel sample of 2.85% Sb, 0.05g/t Au, 1.6g/t Ag over 1.6m reported at adit entrance by Golden Hind Ventures along with 30% Sb, 28.27 g/t Au, 44.8g/t Ag over 0.43m, 800m along strike. (Sheppard, 1984, Assessment Report)

Stewart Gold-Antimony Mine (MOD # 002E\10 AU001) –

- sporadic production from 1890 to 1916

- Shaft to ~30m depth and some development along main stockwork/vein trend

- Samples from the ore dump assayed up to 18 g/t Au, 7% zinc and 14g/t gold by Pleasant Ridge Resources Inc. (Kruse, 2014, Technical Report)

- 2014 due-diligence sample by Kruse graded 8.10g/t Au and 926ppm Cu.

Taylors Room Gold Prospect (MOD # 002E\10 AU002) –

- shaft to ~50m depth with some development reported

- Swarm of ~50 small qtz-asp-py-sb veins ~300m long by several metres wide

- Numerous trenches to be cleaned out and sampled

- Quinlan grab samples up to 32.2 g/t Au, 22opt Ag, 10% zinc and 1.4 % Cu (Quinlan 2013 Assessment Report).

Western Head Cu-Mo Porphyry Target (MOD # 002E\10 CU005) –

- porphyry body ranges over ~1000m in diameter

- Consistent soil/rock geochem anomalies in Cu, Mo, Au and Ag, no drilling

- Chip sampling in 1967 by Newmont (returned 0.13% Cu, 300ppb Au over 61m and 0.42% Cu, 600ppm Au over 13m (Fogwill, 1968, Report on Western Head Cu Prospect)

- Quinlan continuous channel of 57m assayed 0.22% Cu, 37 ppb Au & 37 ppm Mo incl 22m of 0.41% Cu, 59 ppb Au, 73 ppm Mo (Quinlan, 2013 Assessment Report)

- Quinlan 2024 Winkie 4 holes to 50-60m at 45o in four compass directions – all hit mineralized Cu-Au-Ag stockwork in altered felsics (0.1-0.3% Cu, 50-350ppb Au plus Ag) (Quinlan, 2024 Assessment Report)

Churchill intends to immediately conduct a re-sampling program on the surface showings and any accessible historical workings, and compilations of all historical data already in progress. The entire property requires modern, helicopter-borne geophysical and LiDAR surveys and Churchill has identified a leading contractor to do this work. Follow-up prospecting and systematic trenching, with channel sampling work as required, are being planned with initiation this coming Spring; the derived geological and geochemical data will used to outline targets along strike and at depth to the historical workings.

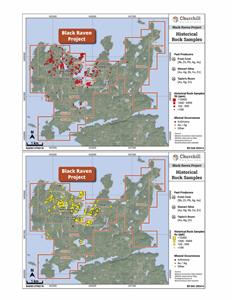

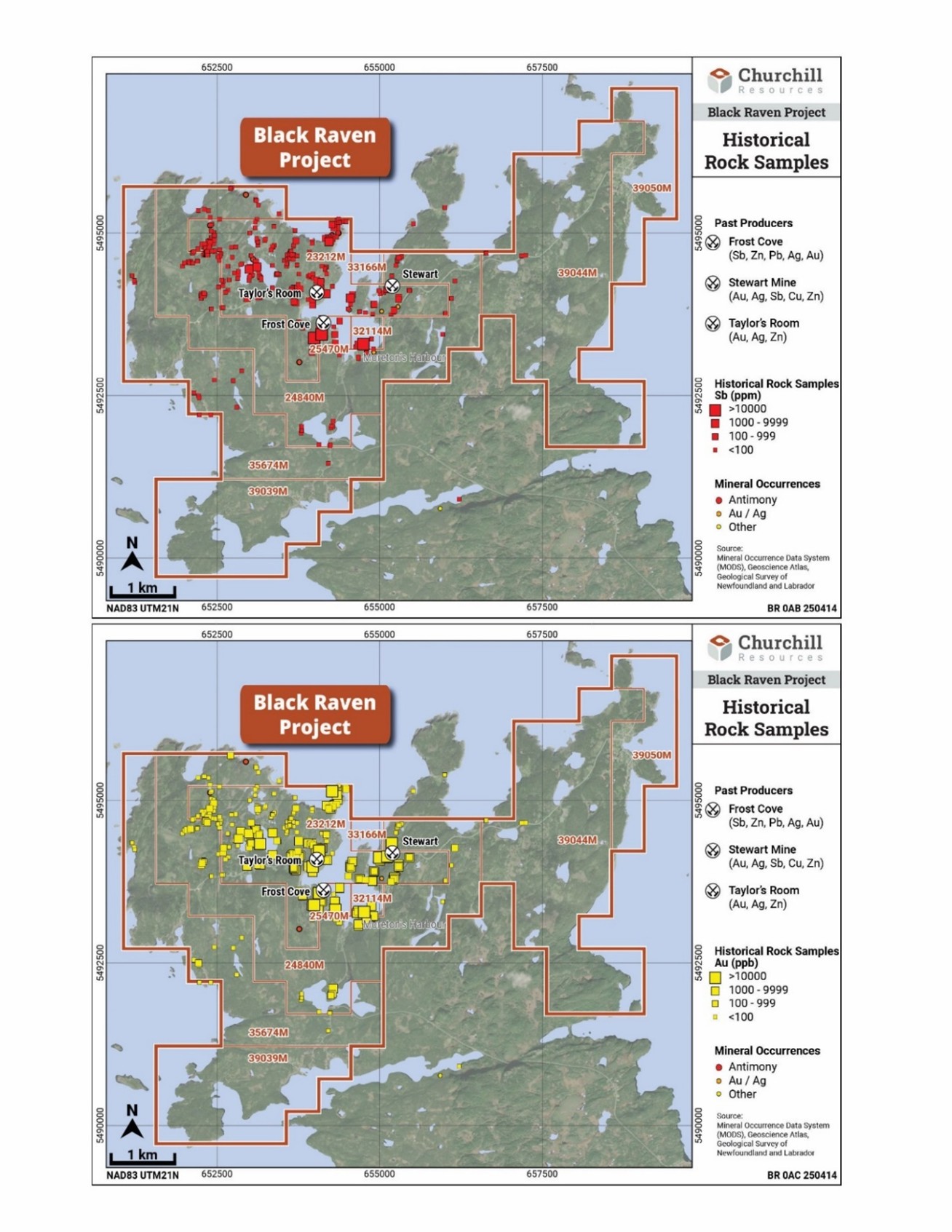

The data reported in this News Release is historic in nature and has not yet been verified by a Qualified Person. Churchill has relied on the information supplied in the Government of Newfoundland filed assessment reports and from information found in MODS published by the Newfoundland Department of Natural Resources. The surface grab samples described in this news release are selective by nature and are unlikely to represent average grades of the property. Historical surface antimony and gold results are presented in the following figures.

Black Raven Property

The Black Raven Property is comprised of nine map-staked licenses constituting a single contiguous block of 125 claims that in total which cover 3,125ha or 31.25km2. Churchill and the vendors have agreed to a 4km wide area of interest around the property boundaries as part of this agreement.

LOI Terms

Under the terms of the LOI, the Company shall have the exclusive option for a period of 24 months to acquire an undivided 100% ownership interest in the Black Raven Antimony Property by:

- issuing an aggregate of 2,000,000 common shares in the capital of Churchill (“Common Shares”) to the Quinlans upon the execution date of a definitive option agreement (“Option Agreement”) and making a cash payment of $20,000;

- incurring a minimum of $1,200,000 in exploration expenditures within 24 months following the execution date of the Option Agreement, provided that a minimum of $400,000 in exploration expenditures is incurred on or prior to the date that is 12 months following the execution date of the Option Agreement

- issuing an aggregate of 4,000,000 Common Shares to the Quinlans on or prior to the date that is 12 months following the execution of the Option Agreement and making a cash payment of $40,000; and

- issuing an aggregate of 6,000,000 Common Shares to the Quinlans on or prior to the date that is 24 months following the execution of the Option Agreement and making a cash payment of $60,000.

Following the date that the option is deemed to have been exercised in accordance with its terms, Churchill will issue and grant to the Quinlans a 2.0% net smelter royalty on any minerals produced from the claims comprising the Black Raven Antimony Property. If the option is exercised, Churchill will also make a one-time cash payment to the Quinlans in the amount of $100,000 on or prior to the date that is the sixth anniversary of the execution of the Option Agreement.

The transaction, including the issuance of Common Shares to the Quinlans, is subject to all the necessary approvals from the TSX Venture Exchange (“TSXV”). Any securities issued in connection with the transaction will be subject to applicable statutory hold periods.

The technical and scientific information in this news release has been reviewed and approved by Dr. Derek H.C Wilton, P.Geo., FGC, who is a “qualified person” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Mr. Wilton is an honourary research professor of Economic Geology at Memorial University in St. John’s and is independent of the Company for the purposes of NI 43-101.

References:

Fogwill, W.D., 1968. Report on a copper prospect at Western Head, Moreton’s Harbour in the Notre Dame Bay Area, Newfoundland. Newfoundland and Labrador Geological Survey, Assessment File 2E/10/0350, 1968, 48 pages

Kruse, Stefan, 2014. Technical Report on the Black Raven Property, Moreton’s Harbour Area Newfoundland and Labrador, Canada for Pleasant Ridge Resources Inc., May 14, 2014

Quinlan E, 2013. First Year Assessment Report for 019872M, Ninth Year Assessment Report for 015553M, and Third Year Assessment Report for 017787M for Exploration within the Black Raven Property, NTS Map Sheet 2E/10. Newfoundland and Labrador Geological Survey Assessment Report, 69 pages

Sheppard, B., 1984. First Year Assessment Report on Geological, Geochemical and Geophyisical Exploration on License 2363 on Claim Blocks 3533-3534 in Moreton’s Harbour Area on New World Island, Notre Dame Bay, Newfoundland and Labrador Assessment File 2E/10/0507, 1984, 28 pages.

About Churchill Resources

Churchill Resources Inc. is a Canadian exploration company focused on strategic, critical minerals in Canada, principally at its prospective Taylor Brook, Florence Lake, and Black Raven properties in Newfoundland & Labrador. The Churchill management team, board, and advisors have decades of combined experience in mineral exploration and in the establishment of successful publicly listed mining companies, both in Canada and around the world. Churchill’s Newfoundland and Labrador projects have the potential to benefit from the province’s large and diversified minerals industry, which includes world class nickel mines and processing facilities, and a well-developed mineral exploration sector with locally based drilling and geological expertise.

Further Information

For further information regarding Churchill, please contact:

Churchill Resources Inc.

Paul Sobie, Chief Executive Officer

psobie@churchillresources.com

Tel. 416.365.0930 (o)

647.988.0930 (m)

Alec Rowlands, Business Development & IR

Alec.rowlands1@gmail.com

Tel. 416.721.4732 (m)

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about Churchill’s objectives, goals and exploration activities proposed to be conducted on its properties; future growth potential of Churchill, including whether any proposed exploration programs at any of its properties will be successful; exploration results; and future exploration plans and costs. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. In particular, this release contains forward-looking information relating to, among other things, the entering into of a definitive Option Agreement and other ancillary transaction documents with respect to the Black Raven Antimony Property and the exercise of such option; the number of Common Shares that may be issued in connection with the transactions discussed herein, closing conditions and receive necessary regulatory approvals These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Such factors, among other things, include: exploration results on the Black Raven Antimony Property; the expected benefits to Churchill relating to the exploration proposed to be conducted on its properties; receipt of all regulatory approvals in connection with the transaction contemplated herein; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Churchill’s properties, if required; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; and title to properties. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Churchill cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Churchill assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

An infographic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9356bd16-4799-4797-a465-84fafebf0cf5

Distribution channels: Banking, Finance & Investment Industry, Media, Advertising & PR ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release