NorthWest Announces Target Model at Kwanika with Higher-Grade Zones Over Significant Thicknesses to Support New Strategic Approach

/EIN News/ -- VANCOUVER, British Columbia, April 10, 2025 (GLOBE NEWSWIRE) -- NorthWest Copper (“NorthWest” or the “Company”) (TSX-V: NWST) announces a new higher grade target model for Kwanika, which represents the first step in advancing on one of the Company’s strategic initiatives to enhance the value of the existing PEA1 on its 100% owned Kwanika-Stardust project through a staged development approach.

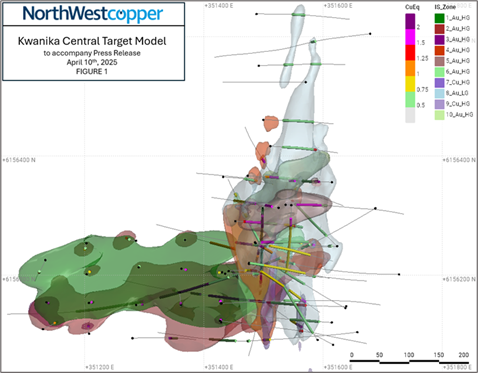

A new three-dimensional (3D) target model, available here (Kwanika Higher-Grade 3D Target Model), has been developed to improve the understanding of the geometry and continuity of higher-grade zones within the current Mineral Resource at Kwanika. The higher-grade zones are based on an inflection in the gold assay distribution, indicative of a higher-grade sub-population above 1.0g/t. Visual inspection of higher-grade values shows them to be continuous and correlate with 3D zones that define the new target model. Gold values were used as the primary basis for correlations, as it is believed gold is less susceptible to re-mobilization and as such a better indicator of primary mineralizing pathways than copper. The resulting target zones generally form two wide parallel zones that take various turns as they migrate 30 degrees up-plunge from west to east, potentially enhancing previous models.

The 3D target model zones support a target size range between 15 to 30 million tonnes of higher-grade mineralized material mostly from two broad parallel zones with a combined mineralized true width ranging between 30m and 45m at higher grades between 1.5% and 2.5% CuEq2.

CEO Paul Olmsted stated, “The creation of the target model is a significant step in moving forward on our strategy to focus on higher-grade zones at Kwanika. The target model will provide a base for executing on our planned phased approach with the initial phase focusing on a higher-grade, lower capital cost development project. This is in line with our objective to enhance the value of the current PEA.”

The higher-grade target zones are grouped into three areas based on zone orientations, summarized as follows:

- The Western area has two key parallel zones trending east-west, dipping 47 degrees north, with drill intercept grades between 1.7% and 1.8% CuEq, and true widths estimated between 20m and 24m each (Au_HG_1, Au_HG_2).

- The Central area has two key parallel zones trending north-south, dipping 55 degrees east, with drill intercept grades between 2.2% and 2.5% CuEq, and true widths estimated between 10m and 14m each (Zones Au_HG_4, Au_HG_6).

- The PEA pit area has two key sub-parallel zones trending east-west, variably dipping between 49 and 66 degrees, with drill intercept grades between 1.7% and 2.4% CuEq, and true widths estimated between 11m and 29m each (Au_HG_5, Au_HG_10). In addition, a low-grade zone is interpreted to potentially support open pit mining in this area (Au_LG_8).

Regardless of area, the two parallel higher-grade target zones are separated by up to 20m of unmineralized dykes. Other smaller target zones are also beginning to be identified that require more drilling to define (Au_HG_3, Cu_HG_7, Cu_HG_9).

Drill holes at Kwanika have multiple orientations that complicate the interpretation and reporting of historical results. To help, the Company has created a 3D model available via Seequent Central’s Open Scene with the goal of assisting stakeholders to understand historical drilling in the context of the new target model. The target model was interpreted into distinct higher-grade zones based on position and orientation of mineralization from historical drill holes. Using the current mineral resource drill hole database, the drill holes were intersected with the target model and screened for the more representative, higher-angle intercepts reported in Table 1, representing 52 of a total of 90 drill holes intersecting the target model. The selected drill hole locations are shown in Figure 1 with collar details provided in Table 2.

The higher-grade target model also helps to assess potential next steps. Additional infill and step-out drilling is required to confirm, extend, and enhance the confidence of the higher-grade target zones and planning is underway to define a phased drill program, to achieve a regular 50m drill spacing across some target zones in addition to testing targets beyond the model extents.

VP Business Development and Exploration Geoff Chinn, P. Geo., stated, “The higher-grade targets identified within the current Kwanika mineralization allows the Company to assess opportunities to extend and better define the zones in leading to potential alternative mining methods and an updated PEA. The two broad parallel zones identified represent a combined mineralized true width ranging between 30m and 45m at higher grades between 1.5% and 2.5% CuEq that provide an interesting basis for alternative potential bulk mining methods than the block cave envisioned in the current PEA. In addition, considering the grade-recovery relationship developed during the metallurgical test work used in the current PEA, the potential for enhanced recoveries by flotation alone looks promising for both copper and gold.”

The Company will provide additional updates on its progress in advancing the plan for the coming year.

The target model was developed by Geoff Chinn P.Geo. and checked by comparing the zones to logged geology, reviewing plans and cross-sections, and reviewing core photos. In addition, the target model was peer-reviewed by James Lang Ph.D, P.Geo..

Executive Changes

The Company also announces that Sapan Bedi will be appointed as the Interim CFO and Corporate Secretary of the Company upon the departure of Lauren McDougall, the current CFO and Corporate Secretary, effective on or about April 25, 2025.

The Company would like to welcome Mr. Bedi to the NorthWest team. Mr. Bedi is a seasoned finance professional with over twenty years experience in the mining industry bringing deep expertise across a broad range of financial disciplines supporting exploration, development and large-scale operations. He is a CPA (Colorado, USA) and a CA (India) and has held senior finance roles at Li-Cycle Holdings Corp, IAMGOLD Corporation and Inmet Mining Corporation.

Ms. McDougall will assist the Company to ensure a successful transition of responsibilities prior to her departure. The Company would like to thank Ms. McDougall for her commitment and leadership over the past 4 years and wish her well in her new career opportunity and future endeavours.

Technical aspects of this news release have been reviewed, verified, and approved by Geoff Chinn, P.Geo., VP Business Development and Exploration for NorthWest, who is a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Minerals Projects.

Figure 1. Kwanika Central - Select high-angle intercept drill holes locations.

Table 1. Select high-angle historical drill hole intercepts of the target model

| West Area | |||||||||

| Zone | Hole3 | From | To | Length | Cu % | Au g/t | Ag g/t | CuEq4,5 | Est. True Width6 |

| 1_Au_HG | K-07-30 | 376 | 390 | 14 | 0.51 | 0.96 | 1.82 | 1.25 | 11 |

| 1_Au_HG | K-07-51 | 302 | 398 | 96 | 1.08 | 0.97 | 2.47 | 1.85 | 67 |

| 1_Au_HG | K-07-52 | 376 | 398 | 22 | 0.42 | 0.71 | 1.56 | 0.98 | 15 |

| 1_Au_HG | K-07-53 | 276 | 316 | 40 | 0.99 | 0.92 | 2.17 | 1.71 | 28 |

| 1_Au_HG | K-07-54 | 512 | 528 | 16 | 0.13 | 2.03 | 0.73 | 1.68 | 11 |

| 1_Au_HG | K-07-55 | 330 | 394 | 64 | 1.12 | 1.90 | 3.66 | 2.59 | 47 |

| 1_Au_HG | K-08-107 | 422 | 430 | 8 | 0.84 | 0.25 | 1.29 | 1.05 | 6 |

| 1_Au_HG | K-08-113 | 322 | 386 | 64 | 0.60 | 1.97 | 1.63 | 2.10 | 52 |

| 1_Au_HG | K-08-58 | 428 | 472 | 44 | 0.72 | 1.36 | 2.34 | 1.77 | 31 |

| 1_Au_HG | K-08-60 | 406 | 422 | 16 | 1.41 | 1.75 | 3.61 | 2.77 | 11 |

| 1_Au_HG | K-08-63 | 472 | 500 | 28 | 0.55 | 1.51 | 1.93 | 1.71 | 19 |

| 1_Au_HG | K-08-78 | 482 | 520 | 38 | 0.84 | 1.13 | 1.72 | 1.71 | 26 |

| 1_Au_HG | K-08-86 | 536 | 544 | 8 | 0.32 | 1.30 | 0.83 | 1.32 | 6 |

| 1_Au_HG | K-08-90 | 494 | 526 | 32 | 0.58 | 0.92 | 1.62 | 1.29 | 23 |

| 1_Au_HG | K-08-91 | 520 | 546 | 26 | 0.49 | 0.97 | 1.17 | 1.23 | 18 |

| 1_Au_HG | K-08-93 | 422 | 470 | 48 | 0.76 | 1.17 | 1.76 | 1.66 | 33 |

| 1_Au_HG | K-08-96 | 442 | 470 | 28 | 1.26 | 1.46 | 3.25 | 2.40 | 19 |

| 1_Au_HG | K-18-180 | 326 | 338 | 12 | 0.67 | 2.29 | 2.32 | 2.43 | 11 |

| 1_Au_HG | K-18-180 | 344 | 372 | 28 | 0.30 | 1.13 | 0.89 | 1.17 | 26 |

| 1_Au_HG | K-18-182 | 352 | 392 | 40 | 0.45 | 0.53 | 1.89 | 0.88 | 34 |

| Average | 34 | 0.77 | 1.27 | 2.11 | 1.76 | 24 | |||

| West Area | |||||||||

| Zone | Hole | From | To | Length | Cu % | Au g/t | Ag g/t | CuEq | Est. True Width |

| 2_Au_HG | K-07-51 | 422 | 458 | 36 | 0.33 | 0.58 | 1.09 | 0.78 | 24 |

| 2_Au_HG | K-07-52 | 458 | 474 | 16 | 1.01 | 1.07 | 2.79 | 1.85 | 11 |

| 2_Au_HG | K-07-53 | 338 | 398 | 60 | 0.83 | 0.86 | 2.81 | 1.51 | 40 |

| 2_Au_HG | K-07-54 | 566 | 584 | 18 | 0.33 | 1.00 | 1.30 | 1.10 | 12 |

| 2_Au_HG | K-07-55 | 408 | 444 | 36 | 0.65 | 0.72 | 1.84 | 1.21 | 25 |

| 2_Au_HG | K-08-107 | 442 | 464 | 22 | 0.97 | 0.34 | 2.55 | 1.25 | 15 |

| 2_Au_HG | K-08-113 | 400 | 456 | 56 | 0.94 | 2.31 | 2.34 | 2.72 | 44 |

| 2_Au_HG | K-08-58 | 480 | 498 | 18 | 0.19 | 0.65 | 0.94 | 0.69 | 12 |

| 2_Au_HG | K-08-59 | 350 | 364 | 14 | 2.01 | 1.79 | 5.02 | 3.41 | 11 |

| 2_Au_HG | K-08-60 | 426 | 440 | 14 | 0.63 | 0.63 | 2.06 | 1.13 | 9 |

| 2_Au_HG | K-08-63 | 510 | 520 | 10 | 0.33 | 1.04 | 1.05 | 1.13 | 7 |

| 2_Au_HG | K-08-78 | 602 | 612 | 10 | 0.39 | 1.14 | 0.89 | 1.27 | 7 |

| 2_Au_HG | K-08-86 | 634 | 654 | 20 | 0.42 | 1.33 | 1.16 | 1.44 | 13 |

| 2_Au_HG | K-08-91 | 698 | 712 | 14 | 0.39 | 1.01 | 1.82 | 1.17 | 9 |

| 2_Au_HG | K-08-93 | 474 | 510 | 36 | 1.10 | 1.26 | 3.48 | 2.08 | 24 |

| 2_Au_HG | K-08-96 | 476 | 506 | 30 | 1.10 | 1.17 | 2.66 | 2.01 | 20 |

| 2_Au_HG | K-08-97 | 434 | 450 | 16 | 1.87 | 0.88 | 3.93 | 2.58 | 11 |

| 2_Au_HG | K-18-180 | 372 | 424 | 52 | 1.10 | 2.16 | 3.07 | 2.77 | 47 |

| 2_Au_HG | K-18-182 | 416 | 478 | 62 | 0.44 | 0.82 | 1.60 | 1.08 | 52 |

| Average | 28 | 0.79 | 1.18 | 2.30 | 1.71 | 21 | |||

| West Area | |||||||||

| Zone | Hole | From | To | Length | Cu % | Au g/t | Ag g/t | CuEq | Est. True Width |

| 3_Au_HG | K-07-53 | 414 | 426 | 12 | 0.78 | 0.62 | 3.23 | 1.28 | 7 |

| 3_Au_HG | K-08-107 | 500 | 510 | 10 | 0.81 | 1.46 | 2.65 | 1.94 | 6 |

| 3_Au_HG | K-08-113 | 522 | 528 | 6 | 0.57 | 1.17 | 3.03 | 1.49 | 4 |

| 3_Au_HG | K-08-96 | 554 | 576 | 22 | 1.32 | 1.06 | 2.88 | 2.15 | 12 |

| 3_Au_HG | K-08-97 | 460 | 468 | 8 | 0.98 | 1.00 | 2.73 | 1.77 | 4 |

| 3_Au_HG | K-18-180 | 452 | 458 | 6 | 0.81 | 1.38 | 4.06 | 1.90 | 5 |

| Average | 11 | 0.98 | 1.07 | 3.02 | 1.82 | 9 | |||

| Central Area | |||||||||

| Zone | Hole | From | To | Length | Cu % | Au g/t | Ag g/t | CuEq | Est. True Width |

| 4_Au_HG | K-07-29 | 240 | 272 | 32 | 0.68 | 2.97 | 1.72 | 2.95 | 30 |

| 4_Au_HG | K-07-32 | 207 | 212 | 6 | 0.07 | 0.14 | 0.20 | 0.17 | 5 |

| 4_Au_HG | K-07-46 | 348 | 356 | 8 | 0.59 | 0.91 | 2.76 | 1.32 | 7 |

| 4_Au_HG | K-08-62 | 272 | 284 | 12 | 2.68 | 1.11 | 4.79 | 3.56 | 11 |

| 4_Au_HG | K-08-65 | 294 | 304 | 10 | 1.44 | 0.21 | 1.54 | 1.61 | 9 |

| 4_Au_HG | K-20-198 | 330 | 340 | 10 | 1.38 | 1.19 | 6.84 | 2.35 | 9 |

| 4_Au_HG | K-22-255 | 298 | 320 | 22 | 0.94 | 0.26 | 2.47 | 1.17 | 19 |

| Average | 14 | 1.08 | 1.37 | 2.75 | 2.15 | 12 | |||

| Central Area | |||||||||

| Zone | Hole | From | To | Length | Cu % | Au g/t | Ag g/t | CuEq | Est. True Width |

| 6_Au_HG | K-07-29 | 274 | 288 | 14 | 1.01 | 1.85 | 2.78 | 2.44 | 13 |

| 6_Au_HG | K-07-46 | 364 | 396 | 32 | 0.37 | 0.89 | 1.17 | 1.06 | 30 |

| 6_Au_HG | K-08-62 | 286 | 314 | 28 | 2.87 | 1.69 | 4.30 | 4.19 | 26 |

| 6_Au_HG | K-20-198 | 344 | 353 | 9 | 1.13 | 3.35 | 3.48 | 3.70 | 8 |

| 6_Au_HG | K-20-198 | 355 | 368 | 13 | 0.76 | 0.90 | 2.82 | 1.47 | 12 |

| Average | 19 | 1.32 | 1.49 | 2.76 | 2.48 | 16 | |||

| Central Area | |||||||||

| Zone | Hole | From | To | Length | Cu % | Au g/t | Ag g/t | CuEq | Est. True Width |

| 7_Cu_HG | K-08-62 | 242 | 256 | 14 | 0.98 | 0.50 | 2.91 | 1.39 | 11 |

| 7_Cu_HG | K-08-65 | 282 | 294 | 12 | 0.82 | 0.11 | 1.28 | 0.92 | 9 |

| 7_Cu_HG | K-20-198 | 310 | 316 | 6 | 1.04 | 0.50 | 3.19 | 1.44 | 5 |

| Average | 11 | 0.93 | 0.35 | 2.35 | 1.22 | 10 | |||

| Central Area | |||||||||

| Zone | Hole | From | To | Length | Cu % | Au g/t | Ag g/t | CuEq | Est. True Width |

| 9_Cu_HG | K-08-62 | 130 | 156 | 26 | 1.12 | 0.43 | 2.83 | 1.47 | 17 |

| 9_Cu_HG | K-22-255 | 152 | 174 | 22 | 2.02 | 0.69 | 6.05 | 2.60 | 13 |

| Average | 24 | 1.53 | 0.55 | 4.30 | 1.99 | 24 | |||

| PEA Pit Area | |||||||||

| Zone | Hole | From | To | Length | Cu % | Au g/t | Ag g/t | CuEq | Est. True Width |

| 5_Au_HG | K-18-180 | 32 | 78 | 46 | 1.29 | 1.13 | 4.16 | 2.18 | 38 |

| 5_Au_HG | K-18-182 | 35 | 90 | 55 | 1.60 | 1.34 | 4.87 | 2.67 | 41 |

| 5_Au_HG | K-21-211 | 34 | 54 | 20 | 1.12 | 0.96 | 3.51 | 1.88 | 19 |

| Average | 40 | 1.40 | 1.20 | 4.37 | 2.35 | 34 | |||

| PEA Pit Area | |||||||||

| Zone | Hole | From | To | Length | Cu % | Au g/t | Ag g/t | CuEq | Est. True Width |

| 10_Au_HG | K-07-28 | 174 | 186 | 12 | 0.72 | 0.94 | 3.22 | 1.46 | 12 |

| 10_Au_HG | K-07-32 | 128 | 146 | 18 | 0.76 | 1.48 | 2.26 | 1.90 | 17 |

| 10_Au_HG | K-18-185 | 128 | 148 | 20 | 1.05 | 0.88 | 4.13 | 1.76 | 18 |

| 10_Au_HG | K-22-230 | 292 | 302 | 10 | 0.30 | 1.79 | 0.92 | 1.67 | 10 |

| Average | 15 | 0.77 | 1.22 | 2.85 | 1.73 | 11 | |||

| PEA Pit Area | |||||||||

| Zone | Hole | From | To | Length | Cu % | Au g/t | Ag g/t | CuEq | Est. True Width |

| 8_Au_LG | K-06-06 | 60 | 76 | 16 | 0.34 | 0.13 | 0.93 | 0.44 | 16 |

| 8_Au_LG | K-07-20 | 114 | 134 | 20 | 0.47 | 0.27 | 1.32 | 0.69 | 19 |

| 8_Au_LG | K-07-24 | 106 | 120 | 14 | 0.42 | 0.21 | 0.90 | 0.58 | 13 |

| 8_Au_LG | K-07-24 | 134 | 198 | 64 | 0.15 | 0.29 | 0.64 | 0.38 | 60 |

| 8_Au_LG | K-07-29 | 40 | 178 | 138 | 0.41 | 0.10 | 0.77 | 0.50 | 135 |

| 8_Au_LG | K-07-29 | 200 | 228 | 28 | 0.40 | 0.20 | 1.18 | 0.56 | 27 |

| 8_Au_LG | K-07-32 | 58 | 102 | 44 | 0.24 | 0.38 | 0.69 | 0.54 | 42 |

| 8_Au_LG | K-07-32 | 117 | 128 | 11 | 0.05 | 0.06 | 0.20 | 0.10 | 11 |

| 8_Au_LG | K-07-32 | 146 | 164 | 18 | 0.17 | 0.38 | 0.55 | 0.46 | 17 |

| 8_Au_LG | K-07-38 | 117 | 134 | 17 | 0.38 | 0.17 | 1.04 | 0.52 | 16 |

| 8_Au_LG | K-07-47 | 178 | 232 | 54 | 0.49 | 0.12 | 1.21 | 0.59 | 53 |

| 8_Au_LG | K-07-49 | 152 | 190 | 38 | 0.55 | 0.22 | 1.35 | 0.73 | 38 |

| 8_Au_LG | K-08-101 | 170 | 182 | 12 | 0.35 | 0.23 | 0.52 | 0.53 | 12 |

| 8_Au_LG | K-08-62 | 156 | 242 | 86 | 0.41 | 0.16 | 1.39 | 0.54 | 83 |

| 8_Au_LG | K-08-65 | 180 | 208 | 28 | 0.36 | 0.12 | 0.60 | 0.46 | 27 |

| 8_Au_LG | K-18-185 | 148 | 206 | 58 | 0.30 | 0.74 | 1.47 | 0.88 | 53 |

| 8_Au_LG | K-20-198 | 214 | 238 | 24 | 0.48 | 0.22 | 1.63 | 0.66 | 23 |

| 8_Au_LG | K-21-205 | 100 | 164 | 64 | 0.54 | 0.22 | 1.70 | 0.72 | 60 |

| 8_Au_LG | K-21-205 | 198 | 230 | 32 | 0.55 | 0.36 | 1.98 | 0.84 | 30 |

| 8_Au_LG | K-21-207 | 70 | 204 | 134 | 0.47 | 0.16 | 1.14 | 0.61 | 125 |

| 8_Au_LG | K-21-208 | 38 | 80 | 42 | 0.78 | 0.32 | 2.52 | 1.05 | 39 |

| 8_Au_LG | K-21-208 | 114 | 178 | 64 | 0.35 | 0.12 | 0.97 | 0.45 | 60 |

| 8_Au_LG | K-21-212 | 72 | 82 | 10 | 0.64 | 0.52 | 2.08 | 1.06 | 9 |

| 8_Au_LG | K-21-212 | 118 | 167 | 49 | 0.19 | 0.45 | 0.92 | 0.54 | 45 |

| 8_Au_LG | K-21-212 | 168 | 268 | 100 | 0.25 | 0.32 | 0.95 | 0.51 | 93 |

| 8_Au_LG | K-21-213 | 41 | 138 | 97 | 0.21 | 0.48 | 0.83 | 0.58 | 93 |

| 8_Au_LG | K-21-213 | 148 | 186 | 38 | 0.25 | 0.14 | 0.70 | 0.36 | 37 |

| 8_Au_LG | K-21-214 | 64 | 160 | 96 | 0.31 | 0.47 | 1.39 | 0.67 | 92 |

| 8_Au_LG | K-22-228 | 112 | 182 | 70 | 0.45 | 0.17 | 1.33 | 0.59 | 70 |

| 8_Au_LG | K-22-229 | 34 | 113 | 79 | 0.51 | 0.18 | 1.36 | 0.66 | 78 |

| 8_Au_LG | K-22-231 | 120 | 154 | 34 | 0.56 | 0.29 | 1.74 | 0.80 | 34 |

| 8_Au_LG | K-22-232 | 35 | 136 | 101 | 0.54 | 0.25 | 2.63 | 0.76 | 101 |

| 8_Au_LG | K-22-233 | 34 | 132 | 98 | 0.74 | 0.24 | 1.84 | 0.94 | 98 |

| 8_Au_LG | K-22-235 | 74 | 98 | 24 | 0.29 | 0.52 | 1.27 | 0.70 | 24 |

| 8_Au_LG | K-22-235 | 150 | 176 | 26 | 0.35 | 0.23 | 0.98 | 0.53 | 26 |

| 8_Au_LG | K-22-236 | 108 | 144 | 36 | 0.28 | 0.33 | 0.81 | 0.54 | 35 |

| 8_Au_LG | K-22-255 | 174 | 176 | 2 | 2.66 | 0.67 | 6.52 | 3.23 | 2 |

| 8_Au_LG | K-22-255 | 176 | 190 | 14 | 0.79 | 0.19 | 2.25 | 0.96 | 13 |

| 8_Au_LG | K-22-255 | 196 | 206 | 10 | 0.80 | 0.33 | 2.69 | 1.08 | 9 |

| Average | 48 | 0.41 | 0.27 | 1.29 | 0.63 | 35 | |||

Table 2. Kwanika Central - Select high-angle historical drill hole collar information

| Hole | Collar X | Collar Y | Collar Z | Collar Azimuth |

Collar Dip | Final Length |

| K-06-06 | 351571 | 6156523 | 1010 | 270 | -55 | 243 |

| K-07-20 | 351537 | 6156318 | 999 | 90 | -60 | 379 |

| K-07-24 | 351433 | 6156364 | 1004 | 90 | -65 | 453 |

| K-07-28 | 351624 | 6156248 | 981 | 314 | -55 | 438 |

| K-07-29 | 351624 | 6156248 | 981 | 265 | -55 | 496 |

| K-07-30 | 351624 | 6156248 | 981 | 270 | -80 | 712 |

| K-07-32 | 351615 | 6156356 | 1000 | 270 | -60 | 465 |

| K-07-38 | 351436 | 6156202 | 998 | 90 | -65 | 585 |

| K-07-46 | 351728 | 6156201 | 979 | 270 | -55 | 624 |

| K-07-47 | 351427 | 6156123 | 988 | 97 | -53 | 423 |

| K-07-49 | 351430 | 6156152 | 996 | 87 | -46 | 392 |

| K-07-51 | 351429 | 6156152 | 996 | 0 | -90 | 694 |

| K-07-52 | 351431 | 6156205 | 998 | 0 | -90 | 664 |

| K-07-53 | 351429 | 6156121 | 988 | 0 | -90 | 559 |

| K-07-54 | 351369 | 6156259 | 1003 | 0 | -90 | 688 |

| K-07-55 | 351359 | 6156171 | 986 | 172 | -87 | 651 |

| K-08-58 | 351363 | 6156211 | 997 | 0 | -90 | 587 |

| K-08-59 | 351281 | 6156094 | 983 | 90 | -80 | 609 |

| K-08-60 | 351287 | 6156150 | 985 | 0 | -90 | 587 |

| K-08-62 | 351639 | 6156148 | 979 | 270 | -58 | 758 |

| K-08-63 | 351291 | 6156213 | 1000 | 0 | -90 | 603 |

| K-08-65 | 351658 | 6156104 | 978 | 270 | -58 | 658 |

| K-08-78 | 351204 | 6156201 | 1003 | 0 | -90 | 685 |

| K-08-86 | 351287 | 6156258 | 1004 | 0 | -90 | 762 |

| K-08-90 | 351134 | 6156225 | 1009 | 190 | -87 | 825 |

| K-08-91 | 351203 | 6156253 | 1004 | 0 | -90 | 797 |

| K-08-93 | 351207 | 6156153 | 995 | 0 | -90 | 752 |

| K-08-96 | 351136 | 6156154 | 986 | 0 | -90 | 771 |

| K-08-97 | 351208 | 6156102 | 984 | 0 | -90 | 844 |

| K-08-101 | 351679 | 6156605 | 1013 | 270 | -55 | 487 |

| K-08-107 | 351130 | 6156109 | 985 | 0 | -90 | 774 |

| K-08-113 | 351442 | 6156207 | 998 | 85 | -80 | 664 |

| K-18-180 | 351499 | 6156313 | 999 | 181 | -66 | 665 |

| K-18-182 | 351499 | 6156313 | 999 | 181 | -75 | 551 |

| K-18-185 | 351526 | 6156313 | 999 | 280 | -68 | 321 |

| K-20-198 | 351688 | 6156312 | 995 | 240 | -56 | 965 |

| K-21-205 | 351453 | 6156290 | 1001 | 90 | -65 | 267 |

| K-21-207 | 351486 | 6156255 | 996 | 90 | -65 | 213 |

| K-21-208 | 351486 | 6156255 | 996 | 120 | -65 | 222 |

| K-21-211 | 351547 | 6156317 | 998 | 180 | -50 | 174 |

| K-21-212 | 351474 | 6156366 | 1003 | 90 | -65 | 274 |

| K-21-213 | 351512 | 6156416 | 1006 | 90 | -60 | 219 |

| K-21-214 | 351500 | 6156460 | 1009 | 90 | -60 | 222 |

| K-22-228 | 351638 | 6156145 | 978 | 300 | -45 | 198 |

| K-22-229 | 351615 | 6156120 | 985 | 270 | -52 | 217 |

| K-22-230 | 351591 | 6156091 | 986 | 320 | -45 | 398 |

| K-22-231 | 351476 | 6156219 | 993 | 120 | -45 | 212 |

| K-22-232 | 351476 | 6156220 | 993 | 95 | -45 | 197 |

| K-22-233 | 351487 | 6156253 | 995 | 100 | -45 | 188 |

| K-22-235 | 351492 | 6156551 | 1014 | 85 | -55 | 242 |

| K-22-236 | 351489 | 6156638 | 1013 | 85 | -55 | 279 |

| K-22-255 | 351617 | 6156083 | 989 | 298 | -65 | 552 |

Quality Assurance and Quality Control (QA/QC)

Kwanika

An independent assay Quality Assurance/Quality Control (QA/QC) program has been in place throughout the drilling campaigns carried out by Serengeti and Northwest Copper since 2006. Control samples have included Certified Reference Materials (CRMs), pulp blanks, and quarter-core twin samples (field duplicates).

CRMs were prepared by CDN Resource Labs Ltd. (CDN) of Langley, BC or by Ore Research & Exploration P/L in Australia. Most of the standards used are certified for both copper and gold values. Two standards are not certified for gold and are deemed “Provisional”. Blank material comprised packets of pulverized barren material. The 2020-2021 drilling campaign used a certified blank, also prepared by CDN. Pulp blanks are used to assess contamination during assaying. During 2021, a small number of coarse blanks (unmineralized garden stone) were used to assess contamination during preparation.

Twin samples were produced by cutting the initial core sample interval in half and leaving one half in the core box. The half to be sent to the laboratory for analyses was then quartered by cutting each piece in half again and putting one quarter of the core in one sample bag and the other quarter of the core in a separate sample bag. Twin samples are generally used to assess sampling precision and mineralization homogeneity.

A full report on QA/QC is available in the 2023 PEA technical report.

About NorthWest Copper:

NorthWest Copper is a copper-gold exploration and development company with a pipeline of advanced and early-stage projects in British Columbia, including Kwanika-Stardust, Lorraine-Top Cat and East Niv. With a robust portfolio in a tier one jurisdiction, NorthWest Copper is well positioned to participate fully in a strengthening global copper market. We are committed to responsible mineral exploration which involves working collaboratively with First Nations to ensure future development incorporates stewardship best practices and traditional land use. Additional information can be found on the Company’s website at www.northwestcopper.ca .

On Behalf of NorthWest Copper Corp.

“Paul Olmsted”

CEO, NorthWest Copper

For further information, please contact:

604-683-7790

info@northwestcopper.ca

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable securities laws. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to statements with respect to; plans and intentions of the Company; proposed exploration and development of NorthWest’s exploration property interests; the Company’s ability to finance future operations; mine plans; magnitude or quality of mineral deposits; the development, operational and economic results of current and future potential economic studies; adding the Lorraine resource to the Kwanika-Stardust Project; the Company’s goals for 2025; geological interpretations; the estimation of Mineral Resources; anticipated advancement of mineral properties or programs; future exploration prospects; the completion and timing of technical reports; future growth potential of NorthWest; and future development plans

All statements, other than statements of historical fact, included herein, constitutes forward-looking information. Although NorthWest believes that the expectations reflected in such forward-looking information and/or information are reasonable, undue reliance should not be placed on forward-looking information since NorthWest can give no assurance that such expectations will prove to be correct. Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information, including the risks, uncertainties and other factors identified in NorthWest’s periodic filings with Canadian securities regulators. Forward-looking information are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking information. Important factors that could cause actual results to differ materially from NorthWest’s expectations include risks associated with the business of NorthWest; risks related to reliance on technical information provided by NorthWest; risks related to exploration and potential development of the Company’s mineral properties; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and First Nation groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as detailed from time to time and additional risks identified in NorthWest’s filings with Canadian securities regulators on SEDAR+ in Canada (available at www.sedarplus.com).

Forward-looking information is based on estimates and opinions of management at the date the information is made. NorthWest does not undertake any obligation to update forward-looking information except as required by applicable securities laws. Investors should not place undue reliance on forward-looking information.

1 See NI 43-101 technical report titled “Kwanika-Stardust Project NI 43-101 Technical Report on Preliminary Economic Assessment” dated February 17, 2023, with an effective date of January 4, 2023, filed under the Company’s SEDAR+ profile at www.sedarplus.com.

2CuEq assumes long term USD metal prices of $2210/oz gold, $4.25/lbs copper and $27.70/oz silver, calculated as follows:CuEq = Cu % + (Au g/t /31.1035g/oz * $2210/oz) / ($4.25/lb * 2204.62lbs/t) * 100 + (Ag g/t /31.1035g/oz * $27.70/oz) / ($4.25/lb*2204.62lbs/t) * 0

3 Holes within 30 degrees of dip direction and moderate to high angle to zone, low-angle holes are filtered out.

4 CuEq assumes long term USD metal prices of $2210/oz gold, $4.25/lbs copper and $27.70/oz silver, calculated as follows: Cu % + (Au g/t /31.1035g/oz * $2210/oz) / ($4.25/lbs * 2204.62lbs/t) * 100 + (Ag g/t /31.1035g/oz * $27.70/oz) / ($4.25/lbs*2204.62lbs/t) * 100

5 Assays from current exploration database, values are uncapped

6 Estimated true widths based on collar dip and average zone dip (180 - (zone dip + collar dip))

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/92443fe9-536e-4eeb-85ea-6f21a09bbede

Distribution channels: Mining Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release