Cerro de Pasco Resources Announces Consolidated Assays of the Drilling Campaign at Quiulacocha Tailings Project, Confirms High-Grade Mineralization, including Significant Gallium Concentrations

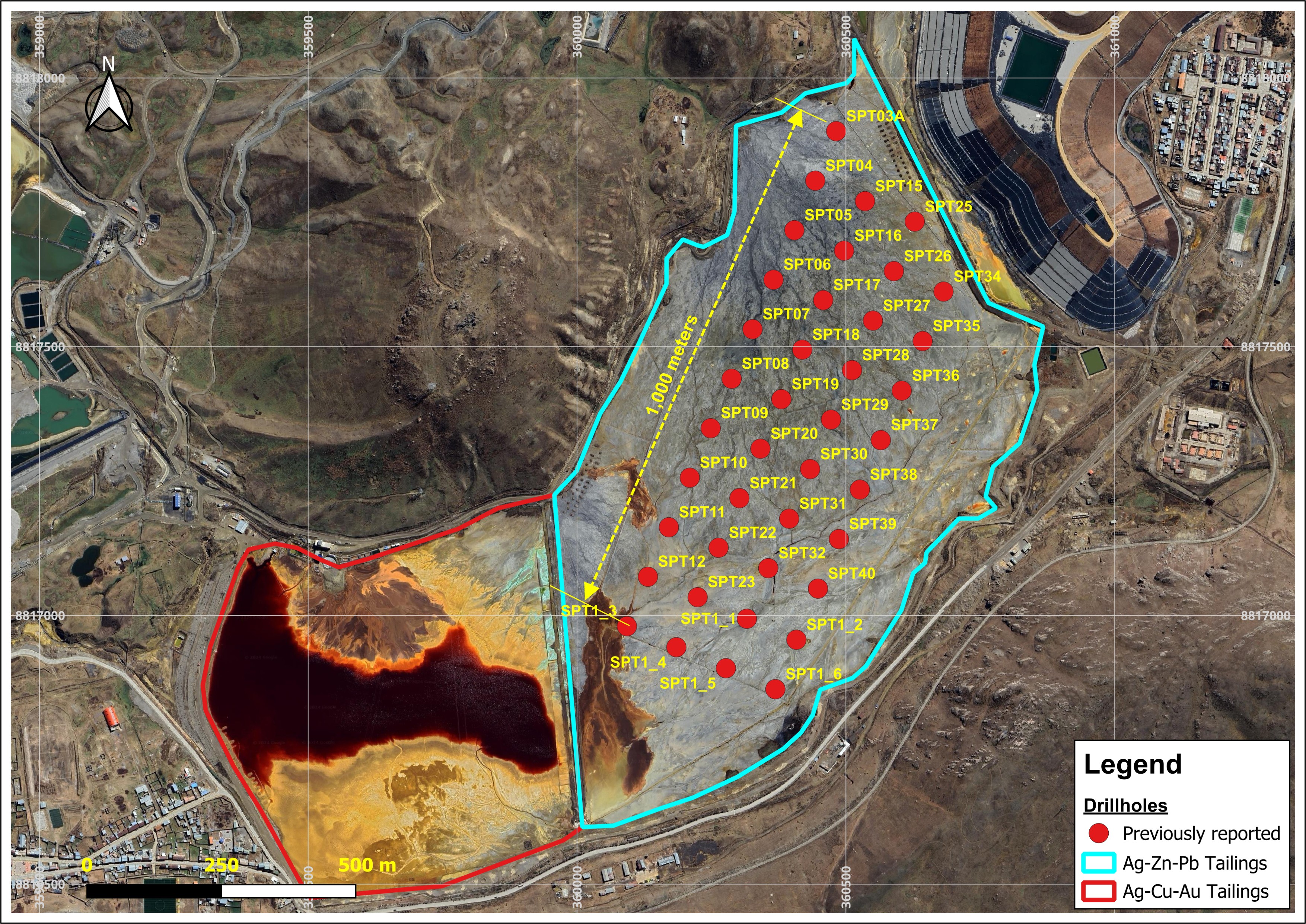

/EIN News/ -- MONTREAL, April 09, 2025 (GLOBE NEWSWIRE) -- Cerro de Pasco Resources Inc. (TSX.V: CDPR) (OTCQB: GPPRF) (FRA: N8HP) (“CDPR” or the “Company”) is pleased to announce the consolidated assay results from its drilling campaign at the Quiulacocha Tailings Project in Central Peru. The 40-hole drilling campaign, comprising assays over a 300 x 1,000-meter area (Figure 1), has confirmed high-grade intersections of silver (Ag), zinc (Zn), lead (Pb), copper (Cu), and gold (Au), while also revealing significant concentrations of gallium (Ga), a critical metal with growing strategic importance due to recent geopolitical developments.

Key Highlights

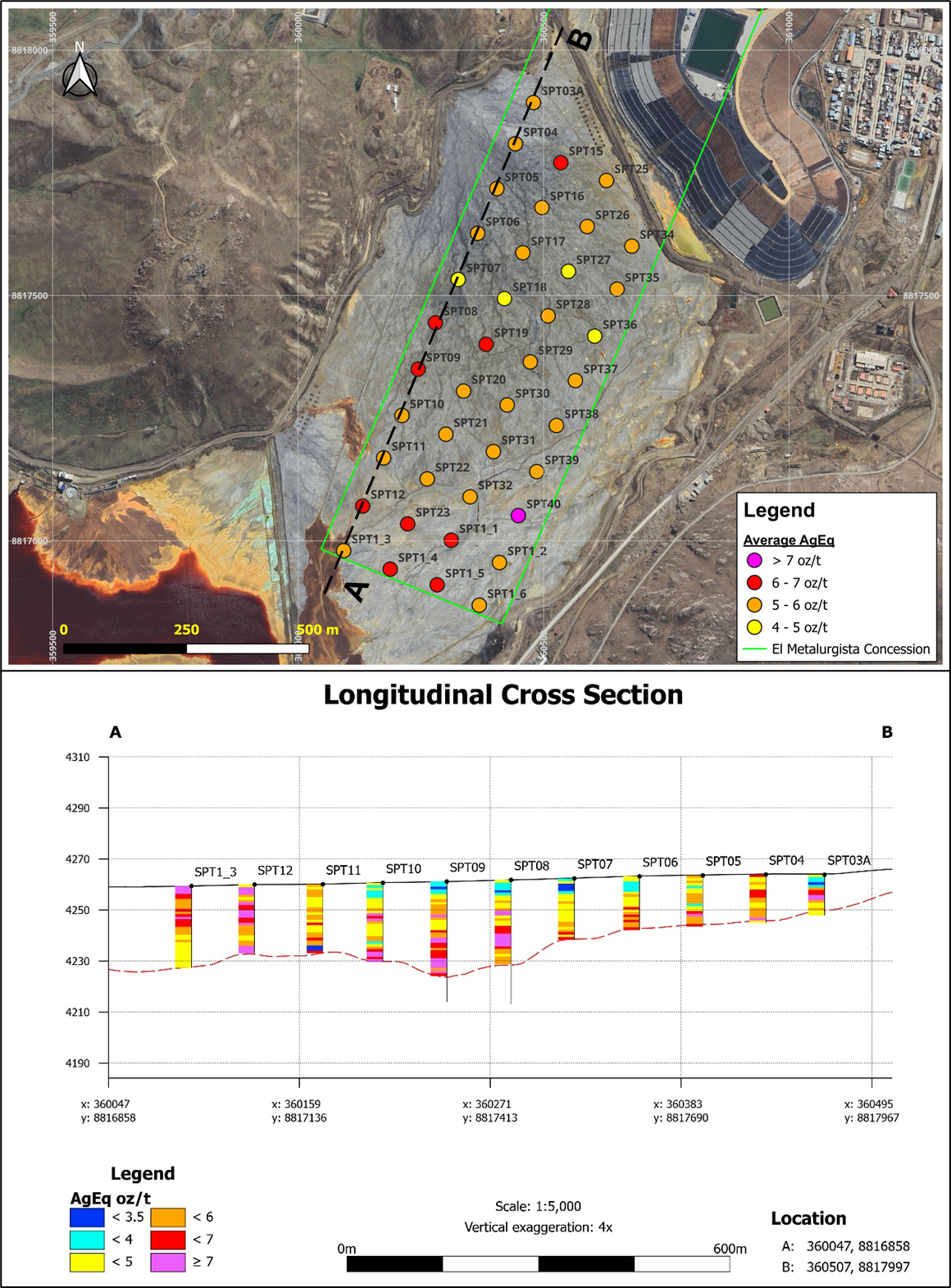

- Grade Consistency: Assays show grade consistency at both depth and laterally across the drilled area, enhancing confidence in the project's resource potential (Figure 2), with gallium, lead, copper and gold concentrations increasing in the southern section.

- High-Grade Mineralization: The drilling program consistently intersected elevated grades of silver, zinc, lead, and gallium. The average grade across all samples was 5.5 oz/t AgEq1, including 1.7 oz/t (52 g/t) Ag, 1.5% Zn, 0.9% Pb, and 53 g/t Ga (Table 1 and Table 2).

- Strategic Gallium Discovery: Gallium, a critical metal used in advanced electronics and renewable energy technologies, was identified throughout the tailings, with grades increasing towards the south and 9% of samples exceeding 100 g/t Ga.

- Significant Pyrite Potential: Based on historical mineralogical reports and current core logging, pyrite constitutes approximately 50% of the tailings and may represent a valuable by-product.

-

Mineralogical and Metallurgical studies are underway to confirm metal recoveries and will investigate gallium and pyrite’s potential to add significant value to the project.

“The successful completion of this drilling campaign marks a significant milestone for Cerro de Pasco Resources,” said Guy Goulet, CEO. “We are thrilled with the assay results, which not only confirm the high-grade nature of the Quiulacocha Tailings but also highlight significant gallium concentrations—a critical metal with rising global demand. The consistency of silver, zinc, and lead mineralization, coupled with the potential for valuable by-products like gallium and pyrite, position this project as a cornerstone of our portfolio. We are anticipating increased copper grades towards the southern part of the deposit based on historic underground copper mining records. We are advancing metallurgical testing and further exploration to unlock the project’s full value.”

Figure 1: 40-hole Quiulacocha Drill Program

Detailed Results

The drilling campaign returned numerous high-grade intersections across the drilled area (Table 1 and Table 2). Key results include:

- Gallium highlights: Drillholes SPT1_4 and SPT1_5 intersected gallium averaging 86 g/t, with near-surface assays of 141 g/t (SPT1_4) and 115 g/t (SPT1_5) in the first 8 meters. Lead grades exceeded 1% Pb, and gallium reached 100-110 g/t in multiple samples, statistically correlating with lead values.

- Copper, gold and silver: Intersections at the bottom of the drilled area yielded grades up to 0.62% Cu, 1.34 g/t Au, and 168 g/t Ag, suggesting a later phase of polymetallic-copper mining distinct from the primary high-grade copper zone further south.

The results indicate a clear trend of increasing lead and gallium concentrations towards the south, alongside intersections of copper-silver-gold tailings in the central and southern parts of the drilled area, expanding the economic potential beyond the initial focus on silver, zinc, and lead.

Ongoing Work

The Company is advancing to the next phase of development with the following steps:

- Mineralogical and Metallurgical Testing: Representative composite samples are being tested to determine the most effective recovery methods for silver, zinc, lead, copper, gold, gallium, and pyrite, providing critical inputs for future technical and economic assessments.

- Phase 2 Drilling: Encouraged by these results, the company is planning an extended drilling campaign in the second half of 2025, targeting the remaining tailings outside the El Metalurgista concession and the primary high-grade copper zone further south.

Figure 2. Main cross section of AgEq (oz/t) across 1,000 meters of the drilled area

Table 1. Average grades of the drilling campaign

| Metal | Grade |

| Silver | 1.66 oz/t |

| Zinc | 1.49% |

| Lead | 0.88% |

| Copper | 0.09% |

| Gold | 0.10 g/t |

| Gallium | 53.2 g/t |

| Indium | 19.9 g/t |

Table 2. Average grades per drillhole

| Drillhole | Length (m) |

Ag (oz/t) |

Ag (g/t) |

% Zn |

% Pb |

% Cu |

Au (g/t) |

Ga (g/t) |

In (g/t) |

% Fe ** |

AgEq (oz/t) * |

| SPT03A | 16 | 1.89 | 58.66 | 1.85 | 0.74 | 0.05 | 0.04 | 21.31 | 16.96 | 32.01 | 5.1 |

| SPT04 | 19 | 1.91 | 59.47 | 1.80 | 0.77 | 0.07 | 0.07 | 30.58 | 18.35 | 32.42 | 5.4 |

| SPT05 | 20 | 1.91 | 59.32 | 1.60 | 0.76 | 0.08 | 0.09 | 25.13 | 17.21 | 30.42 | 5.2 |

| SPT06 | 21 | 1.74 | 54.16 | 1.48 | 0.75 | 0.08 | 0.10 | 29.58 | 17.32 | 28.60 | 5.0 |

| SPT07 | 24 | 1.56 | 48.42 | 1.45 | 0.67 | 0.08 | 0.08 | 30.30 | 19.12 | 28.50 | 4.7 |

| SPT08 | 33 | 1.56 | 48.47 | 1.73 | 0.66 | 0.13 | 0.38 | 32.54 | 20.36 | > 15 | 6.0 |

| SPT09 | 37 | 1.82 | 56.72 | 1.53 | 0.73 | 0.15 | 0.30 | 38.11 | 19.88 | > 15 | 6.0 |

| SPT1_1 | 26 | 1.67 | 51.89 | 1.54 | 1.17 | 0.10 | 0.05 | 83.67 | 11.24 | 25.48 | 6.1 |

| SPT1_2 | 16 | 1.54 | 47.86 | 1.39 | 0.99 | 0.08 | 0.05 | 64.85 | 14.56 | 26.92 | 5.3 |

| SPT1_3 | 32 | 1.69 | 52.43 | 1.18 | 1.07 | 0.10 | 0.05 | 88.30 | 25.21 | 27.95 | 5.9 |

| SPT1_4 | 25 | 1.71 | 53.29 | 1.46 | 1.22 | 0.10 | 0.05 | 91.69 | 15.40 | 26.57 | 6.3 |

| SPT1_5 | 25 | 1.74 | 54.06 | 1.65 | 1.23 | 0.10 | 0.06 | 79.81 | 15.32 | 25.85 | 6.3 |

| SPT1_6 | 17 | 1.74 | 54.13 | 1.49 | 0.95 | 0.07 | 0.05 | 59.85 | 16.74 | 24.80 | 5.5 |

| SPT10 | 31 | 1.51 | 47.10 | 1.30 | 0.87 | 0.10 | 0.13 | 57.85 | 18.25 | 26.94 | 5.3 |

| SPT11 | 27 | 1.37 | 42.65 | 1.22 | 0.84 | 0.09 | 0.07 | 64.36 | 18.91 | 26.24 | 5.0 |

| SPT12 | 27 | 1.66 | 51.55 | 1.28 | 1.30 | 0.11 | 0.07 | 110.07 | 27.56 | 25.78 | 6.7 |

| SPT15 | 19 | 2.35 | 73.09 | 2.10 | 0.90 | 0.12 | 0.12 | 27.30 | 21.86 | 33.85 | 6.5 |

| SPT16 | 19 | 1.78 | 55.44 | 1.64 | 0.70 | 0.08 | 0.09 | 26.21 | 19.08 | 32.04 | 5.1 |

| SPT17 | 21 | 1.76 | 54.71 | 1.50 | 0.70 | 0.08 | 0.09 | 31.05 | 18.20 | 31.21 | 5.0 |

| SPT18 | 22 | 1.62 | 50.27 | 1.31 | 0.65 | 0.08 | 0.09 | 39.63 | 17.38 | 27.78 | 4.8 |

| SPT19 | 28 | 1.69 | 52.58 | 2.03 | 0.95 | 0.09 | 0.11 | 45.75 | 24.66 | > 15 | 6.0 |

| SPT20 | 32 | 1.67 | 51.80 | 1.49 | 0.86 | 0.11 | 0.16 | 44.04 | 22.46 | > 15 | 5.6 |

| SPT21 | 27 | 1.43 | 44.52 | 1.28 | 0.81 | 0.09 | 0.08 | 58.70 | 20.42 | 27.01 | 5.0 |

| SPT22 | 26 | 1.48 | 46.01 | 1.26 | 0.98 | 0.09 | 0.05 | 68.61 | 22.59 | 26.99 | 5.3 |

| SPT23 | 28 | 1.71 | 53.12 | 1.53 | 1.11 | 0.13 | 0.10 | 83.14 | 15.99 | 26.21 | 6.4 |

| SPT25 | 15 | 1.76 | 54.74 | 1.73 | 0.74 | 0.05 | 0.05 | 29.79 | 18.59 | 31.80 | 5.0 |

| SPT26 | 14 | 1.95 | 60.54 | 1.59 | 0.86 | 0.05 | 0.04 | 40.93 | 20.71 | 31.30 | 5.4 |

| SPT27 | 21 | 1.56 | 48.56 | 1.47 | 0.68 | 0.08 | 0.10 | 34.80 | 19.52 | 28.26 | 4.9 |

| SPT28 | 25 | 1.53 | 47.56 | 1.47 | 0.72 | 0.09 | 0.12 | 40.67 | 18.14 | 28.12 | 5.0 |

| SPT29 | 22 | 1.53 | 47.72 | 1.29 | 0.79 | 0.10 | 0.11 | 46.02 | 23.42 | > 15 | 5.0 |

| SPT30 | 25 | 1.48 | 45.95 | 1.27 | 0.80 | 0.10 | 0.08 | 48.17 | 23.92 | > 15 | 5.0 |

| SPT31 | 23 | 1.51 | 47.03 | 1.30 | 0.95 | 0.07 | 0.05 | 61.57 | 19.20 | 27.44 | 5.2 |

| SPT32 | 31 | 1.51 | 46.87 | 1.26 | 0.96 | 0.09 | 0.05 | 64.78 | 26.16 | 26.99 | 5.3 |

| SPT34 | 15 | 1.89 | 58.77 | 1.79 | 0.70 | 0.04 | 0.04 | 31.29 | 18.97 | 30.28 | 5.2 |

| SPT35 | 19 | 1.78 | 55.24 | 1.62 | 0.68 | 0.06 | 0.06 | 40.38 | 20.64 | 28.71 | 5.2 |

| SPT36 | 21 | 1.59 | 49.46 | 1.30 | 0.64 | 0.07 | 0.07 | 32.42 | 17.64 | 28.37 | 4.5 |

| SPT37 | 18 | 1.62 | 50.51 | 1.28 | 0.89 | 0.07 | 0.05 | 49.26 | 20.89 | 28.04 | 5.0 |

| SPT38 | 18 | 1.62 | 50.38 | 1.48 | 0.96 | 0.06 | 0.05 | 55.68 | 19.52 | 28.26 | 5.3 |

| SPT39 | 22 | 1.50 | 46.79 | 1.63 | 0.86 | 0.09 | 0.08 | 50.20 | 17.76 | 27.02 | 5.3 |

| SPT40 | 20 | 1.76 | 54.61 | 1.63 | 1.35 | 0.12 | 0.09 | 96.57 | 25.15 | 24.86 | 7.0 |

| Total | 927 | 1.66 | 51.65 | 1.49 | 0.88 | 0.09 | 0.10 | 53.16 | 19.85 | 25 - 30 | 5.5 |

(*) AgEq is calculated with Ag = $30/oz, Zn = $3,000/t, Pb = $2,000/t, Cu = $9,000/t, Au = $2,500/oz, Ga = $550/kg, and In = $350/kg

(**) Results indicated as ‘> 15% Fe’ correspond to ongoing overlimit assays. The Fe content in all drillholes is 25 – 30% Fe

Drill Program

CDPR engaged Ingetrol Comercial S.A.C., a subsidiary of Grupo Ingetrol (Chile), and ConeTec Peru, a subsidiary of the ConeTec Group (Canada). The campaign utilized percussion and sonic drilling techniques.

On October 23rd 2024, the Company completed the last of 40 drill holes, ahead of the rainy season, collecting more than 1,000 samples over a significant portion of the Quiulacocha tailings deposit. The samples were safely transported to the laboratory in freezer containers.

Laboratory Testing

All samples were stored and transported to Lima in freezer containers to prevent oxidation and preserve sample integrity.

The samples were dried and tested at the Inspectorate Services Lab (Bureau Veritas) and SGS Lab in Lima. Following geochemical and mineralogical testing, representative composites from selected samples will be sent for an advanced metallurgical test work program.

The assay results are derived from a combination of multi-element ICP (detecting 60 elements), Atomic Absorption (for determining upper limits of the metals Zn, Pb, and Cu), and Fire Assay for Au.

Quality Assurance (QA) and Quality Control (QC)

The preparation of samples for Geochemical Analyses comprised drying at 100°C, disaggregation, homogenization, and rotary splitting to obtain a representative pulp sample of 250 grams. The sample does not undergo sieving or any other mechanical preparation (crushing or grinding) to preserve the original grain size distribution.

The laboratories performed all sample preparation and analytical programs, supported by the QA/QC program, which was monitored on a sample lot basis. The CDPR QA/QC program consisted of inserting twin samples, coarse duplicate samples, pulp duplicate samples, standard reference materials, and coarse blank material and further checking at a second laboratory.

Geophysics

CDPR has successfully completed Phase 1 of its geophysical studies, focusing on the dry areas of the Quiulacocha Tailings. Depth readings, conducted by Geomain Ingenieros S.A.C., ranged from 20 to over 40 meters in various locations determined through Electrical Tomography and Multichannel Analysis of Surface Waves (MASW).

The Quiulacocha Tailings

CDPR is the titleholder of the concession “El Metalurgista” in Peru, which grants it the right to explore and exploit the Quiulacocha Tailings within its assigned area. The General Mining Bureau of the Peruvian Ministry of Energy and Mines has formally confirmed the enforceability of these rights.

The Quiulacocha TSF covers approximately 115 ha with tailings deposited from 1921 to 1992. The surface area of the Quiulacocha TSF lying within the El Metalurgista concession is approximately 57 ha, approximately 50% of the total TSF surface area. The tailings are comprised of processing residues from the Raúl Rojas open pit and underground mine. Research indicates that tailings were first deposited on the eastern side of the TSF from January 1921 and were derived from processing of high-grade copper-silver-gold ore, with reported historical head grades of up to 10% Cu, 4 g/t Au and over 300 g/t Ag, sourced from east-west striking veins in the underground mine. The main period of tailings deposition at Quiulacocha came after 1943 when the Paragsha plant was put into commission, first treating copper ore and later processing zinc-lead-silver ore. According to historical records, the Cerro de Pasco mine processed approximately 70 Mt of zinc-lead-silver ore between 1952 and 1996 from the open pit and underground workings with average historical grades of 7.41% Zn, 2.77% Pb and 90.33 g/t Ag.(1)

With estimated minimal mining costs due to surface-level material and potentially available reprocessing capacity at adjacent plants, CDPR's Quiulacocha Project stands out as one of Peru's key mining initiatives. This project will provide economic benefits and aims to restore the environment and create employment opportunities, aligning with the local community's needs.

(1) Page 32 of the technical report dated March 15, 2021, with an effective date of August 31, 2020, is titled "National Instrument 43-101 El Metalurgista Concession- Pasco, Peru", prepared for the Company by co-authors Adrian Martinez and Andrew Sharp of CSA Global Consultants Canada Ltd. The technical report can be found under the Corporation's issuer profile at www.sedarplus.ca.

Technical Information

Mr. Alfonso Palacio Castilla, MIMMM/Chartered Engineer (CEng) and Project Superintendent for CDPR, has reviewed and approved the scientific and technical information contained in this news release. Mr. Palacio is a Qualified Person for the purposes of reporting in compliance with NI 43-101.

Cerro de Pasco Resources

Cerro de Pasco Resources Inc. is focused on the development of its principal 100% owned asset, the El Metalurgista mining concession, comprising silver-rich mineral tailings and stockpiles extracted over a century of operation from the Cerro de Pasco open pit mine in Central Peru. The company’s approach at El Metalurgista entails the reprocessing and environmental remediation of mining waste and the creation of numerous opportunities in a circular economy.

Further Information

Guy Goulet, CEO

Telephone: +1-579-476-7000

Mobile: +1-514-294-7000

ggoulet@pascoresources.com

Forward-Looking Statements and Disclaimer

Certain information contained herein may constitute “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified using forward-looking terminology such as “plans”, “seeks”, “expects”, “estimates”, “intends”, “anticipates”, “believes”, “could”, “might”, “likely” or variations of such words, or statements that certain actions, events or results “may”, “will”, “could”, “would”, “might”, “will be taken”, “occur”, “be achieved” or other similar expressions.

Forward-looking statements, including the expectations of CDPR’s management regarding the realization, timing and scope of its drilling program, the completion of a resource report as well as the business and the expansion and growth of CDPR’s operations, are based on CDPR’s estimates and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of CDPR to be materially different from those expressed or implied by such forward-looking statements or forward-looking information.

Forward-looking statements are subject to business and economic factors and uncertainties and other factors, that could cause actual results to differ materially from these forward-looking statements, including the relevant assumptions and risks factors set out in CDPR’s public documents, available on SEDAR+ at www.sedarplus.ca. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Although CDPR believes that the assumptions and factors used in preparing forward-looking statements are reasonable, undue reliance should not be placed on these statements and forward-looking information. Except where required by applicable law, CDPR disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

1 AgEq is calculated with Ag = $30/oz, Zn = $3,000/t, Pb = $2,000/t, Cu = $9,000/t, Au = $2,500/oz, Ga = $550/kg, and In = $350/kg

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/098d1b0b-c889-4817-b9cf-edadc90adcde

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0a46599c-a3f3-43c1-a4e7-8573d1b376ba

Distribution channels: Banking, Finance & Investment Industry, Mining Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release