Agricultural Adjuvant Market Set To Hit USD 6.9 Bn by 2034 | Top Players - BASF SE, Clariant AG

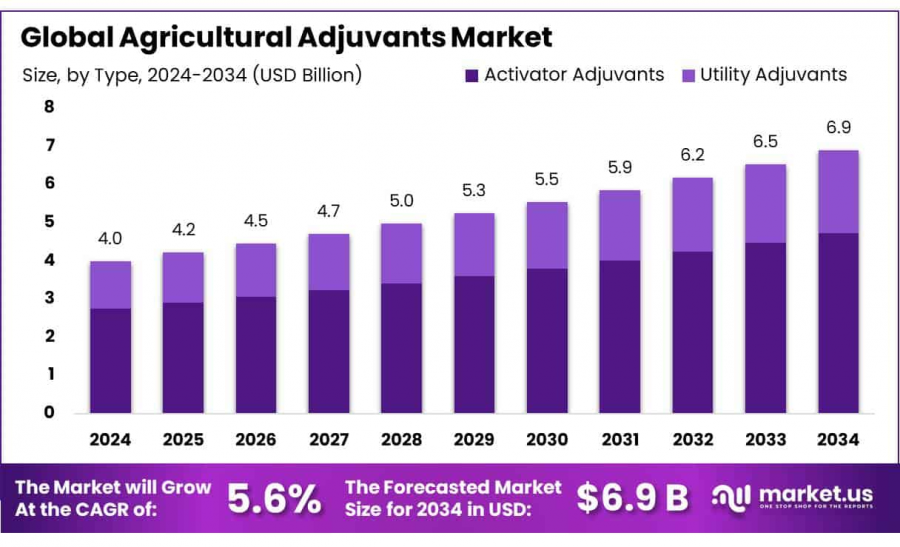

Agricultural Adjuvant Market size is expected to be worth around USD 6.9 Bn by 2034, from USD 4.0 Bn in 2024, growing at a CAGR of 5.6% from 2025 to 2034.

NEW YORK, NY, UNITED STATES, January 22, 2025 /EINPresswire.com/ -- The Global Agricultural Adjuvants Market is experiencing robust growth, driven by the increasing demand for higher crop yields, effective pest control, and environmentally sustainable farming practices. Agricultural adjuvants are substances added to pesticides, herbicides, and fertilizers to enhance their effectiveness and improve application efficiency. These products play a crucial role in modern agriculture by improving the performance of crop protection chemicals, facilitating the uniform distribution of these chemicals, and enhancing their penetration and adherence to plant surfaces. This market is evolving rapidly, with continuous advancements in product formulations and an expanding range of applications across various crops and farming techniques.

Agricultural adjuvants are classified into several categories, including surfactants, oils, wetting agents, emulsifiers, dispersants, and other performance-enhancing chemicals. These additives are essential in optimizing the performance of agrochemicals, ensuring they work more effectively under various environmental conditions. The global demand for agricultural adjuvants is primarily driven by the rising need for precision farming, improved crop productivity, and better pest management practices. With the agricultural industry shifting towards more sustainable and efficient methods, the role of adjuvants has become increasingly significant in ensuring that chemicals are used in a way that maximizes their effectiveness while minimizing their environmental impact.

The major factors driving the growth of the agricultural adjuvants market include the increasing global population, the need for higher food production, and the adoption of modern farming techniques. As the world population continues to grow, the pressure on farmers to produce more food with fewer resources has intensified. Agricultural adjuvants help meet this demand by optimizing the use of pesticides, herbicides, and fertilizers, thereby enhancing crop yield and reducing the loss of valuable nutrients. Furthermore, the growing awareness of the importance of sustainable agriculture and the need to reduce chemical usage in farming practices are encouraging the use of adjuvants to ensure that agrochemicals are applied in the most efficient and environmentally friendly way possible.

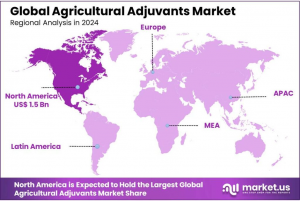

The demand for agricultural adjuvants is steadily rising across various regions, with North America and Europe currently leading the market due to their advanced farming techniques and high adoption rates of agrochemicals. The Asia-Pacific region, however, is expected to see the highest growth in the coming years due to rapid industrialization, increased mechanization in farming, and greater adoption of chemical-based farming practices. The growing use of herbicides and fungicides in countries like India and China is a significant driver of demand in the region.

Recent technological advancements in agricultural adjuvants include the development of more specialized formulations that target specific crop protection needs. Innovations in surfactant technology have resulted in adjuvants that are better suited to certain types of crops or environmental conditions. For example, adjuvants that help agrochemicals penetrate plant cuticles more effectively or those that improve the stability of chemicals under varying weather conditions are becoming more prevalent. These advancements are enabling farmers to achieve more effective pest control and better yield outcomes with lower environmental impact.

Make confident decisions using our insights and analysis. Request a PDF Sample Report@ https://market.us/report/agricultural-adjuvants-market/free-sample/

Key Takeaways

◘ Agricultural Adjuvant market size is expected to be worth around USD 6.9 billion by 2034, from USD 4.0 billion in 2024, growing at a CAGR of 5.6%.

◘ Activator Adjuvants held a dominant market position, capturing more than a 68.6% share of the agricultural adjuvants market.

◘ Tank-Mix held a dominant market position, capturing more than a 78.5% share.

◘ Cereal & Grains held a dominant market position, capturing more than a 44.30% share.

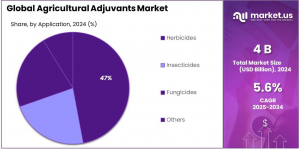

◘ Herbicides held a dominant market position, capturing more than a 48.10% share of the global agricultural adjuvants market.

◘ Asia Pacific (APAC) dominated the global agricultural adjuvants market, holding a significant share of 38.60%, with a market value of approximately USD 1.5 billion.

Agricultural Adjuvants Top Trends

1. Bio-based Adjuvants: There is a growing shift towards bio-based adjuvants driven by environmental concerns and consumer preference for sustainable agricultural products. These adjuvants are gaining popularity as they are perceived to be safer for the environment compared to traditional chemical adjuvants.

2. Precision Agriculture: Adjuvants are increasingly being integrated into precision agriculture practices. The development of adjuvants that are compatible with advanced application technologies like drones (UAVs) is enhancing the efficiency and effectiveness of crop protection products, facilitating targeted application, and reducing wastage.

3. Regulatory Influence: Regulatory policies are significantly impacting the agricultural adjuvants market. Stricter environmental regulations are pushing manufacturers to develop products that comply with new standards for safety and environmental impact, leading to innovation in adjuvant compositions and functionalities.

4. Technological Innovations: Continuous advancements in technology are leading to the development of novel adjuvants that enhance the performance of agrochemicals. Innovations include adjuvants that improve the efficacy of pesticides, increase plant uptake, and reduce the environmental footprint.

5. Increased Demand for Adjuvants in Organic Farming: As the organic farming industry grows, so does the demand for adjuvants that can be used within the stringent guidelines of organic certification. These products help in maximizing the effectiveness of natural pesticides and are tailored to meet the needs of organic farmers.

Key Market Segments

Type Analysis

In 2024, Activator Adjuvants dominated the agricultural adjuvants market, holding a significant 68.6% share. These adjuvants are integral in enhancing the effectiveness of pesticides and herbicides by improving their absorption and adherence to plant surfaces. The continued growth in demand for these products underscores their pivotal role in boosting the performance and efficiency of crop protection products.

Formulation Analysis

Tank-Mix formulations captured a dominant 78.5% market share in 2024, favored for their ability to combine various chemicals into a single mixture. This simplifies the application process, optimizing the use of crop protection products. The increasing popularity of integrated pest management and precision agriculture has further propelled the demand for tank-mix solutions, streamlining application and enhancing crop treatment efficacy.

Crop Type Analysis

Cereal & Grains led the market with a 44.30% share in 2024, driven by the critical need for effective crop protection. The application of adjuvants in this segment is essential for combating pests and diseases, vital for securing food production, and enhancing yields in staple crops like wheat, rice, corn, and barley.

Application Analysis

Herbicides were the largest application segment, accounting for over 48.10% of the market share. Their extensive use across both conventional and organic farming highlights their importance in controlling weeds that threaten crop health and yield. The incorporation of adjuvants into herbicide formulations is crucial for improving their efficacy, particularly in managing weed resistance and maximizing crop output.

Key Market Segments List

Type

- Activator Adjuvants

- Surfactants

- Non-ionic

- Anionic

- Cationic

- Others

Formulation

- Tank-Mix

- In-Formulation

Crop Type

- Cereal & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Application

- Herbicides

- Insecticides

- Fungicides

- Others

Regulations On the Agricultural Adjuvants Market

1. EPA Oversight: In the United States, the Environmental Protection Agency (EPA) does not generally require agricultural adjuvants to be registered independently if they are used within registered pesticide formulations. However, any adjuvant that is tank-mixed might be treated as part of the pesticide if it affects the pesticide’s efficacy, requiring adherence to specific regulatory standards.

2. State-Specific Requirements: Some states, such as Arkansas, California, Idaho, Kentucky, Maryland, Maine, Mississippi, Tennessee, Utah, Washington, and Wyoming, mandate the registration of certain adjuvants sold or transported within their jurisdictions. These regulations ensure that adjuvants meet local safety and effectiveness criteria before they are allowed on the market.

3. Label Compliance: Labeling is a critical aspect of adjuvant regulation. Adjuvants must be labeled correctly, and labels should provide comprehensive information on safe and effective use. The label requirements may include directions for mixing, environmental precautions, and safety instructions.

4. International Considerations: Other countries might have their own regulatory frameworks. For instance, China has enacted measures to limit harmful solvents in pesticide formulations, reflecting a broader trend towards stricter control over agricultural chemical components to protect human health and the environment.

Buy The Complete Report to read the analyzed strategies Get Discounts of Up to 30%! https://market.us/purchase-report/?report_id=14787

Regional Analysis

Asia Pacific (APAC): Dominating the global market, Asia Pacific held a 38.60% share, valued at around USD 1.5 billion in 2024. The substantial market share is primarily due to the significant growth of the agricultural sector in populous nations such as China and India, along with several Southeast Asian countries. These regions are increasingly adopting advanced agricultural inputs, including adjuvants, to boost crop yield and quality in response to rising food security demands and a growing population.

North America: North America experienced steady growth, accounting for 28.5% of the global market share. The U.S. and Canada are at the forefront, driven by extensive adjuvant usage across various applications including herbicides, insecticides, and fungicides. The regional market is also influenced by a strong inclination towards sustainable farming, with a growing demand for bio-based and environmentally friendly adjuvants.

Europe: With approximately 18.2% of the market share, Europe's market dynamics are largely shaped by stringent environmental regulations, especially within the European Union. The push for organic farming and precision agriculture technologies are key drivers expected to catalyze the demand for safer and eco-friendly adjuvants.

Key Players Analysis

- BASF SE

- Clariant AG

- Croda International Plc

- Ingevity

- Solvay

- Bayer

- Nufarm

- Evonik Industries AG

- Corteva

- Miller Chemical & Fertilizer, LLC

- Helena Agri-Enterprises, LLC

- WinField United

- Stepan Company

- CHS Inc.

- Kalo

- Other Key Players

Conclusion

The global Agricultural Adjuvants Market is on a path of significant growth, influenced by several key trends and innovations. The market is driven by the growing need for sustainable agricultural practices that reduce environmental impact while increasing crop yield and effectiveness of agrochemicals. With the increasing global demand for food, agricultural adjuvants are becoming crucial in enhancing the performance of agrochemicals, which is essential for achieving higher crop productivity and sustainability.

Innovations in adjuvant technology, such as the development of more environmentally friendly and biodegradable adjuvants, are playing a key role. These innovations are supported by stringent regulatory frameworks that promote safer and more efficient farming practices. Furthermore, the adoption of precision farming techniques is fueling the demand for adjuvants that ensure agrochemicals are applied more precisely, thereby reducing waste and improving crop protection.

Strategic Initiatives

—Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

—Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

—Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental impact.

Lawrence John

Prudour

+91 91308 55334

email us here

Distribution channels: Agriculture, Farming & Forestry Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release