Lithium Mining Industry Poised for Exponential Growth Amid Rising Demand for Clean Energy Solutions | Future Market Insights, Inc.

Australia is the world's biggest lithium miner, accounting for 1.4% of the world's lithium reserves. Its significant lithium deposits are found in Western Australia, particularly in the Greenbushes mine. Lithium resources in Argentina are primarily in brine deposits, which are cheaper and more environmentally friendly than hard rock mining. The Chilean government invests in sustainable mining while providing for the benefit of local communities.

/EIN News/ -- NEWARK, Del, Jan. 06, 2025 (GLOBE NEWSWIRE) -- The global lithium mining industry has emerged as a cornerstone of the clean energy transition, driven by the skyrocketing demand for lithium-ion batteries. These batteries power electric vehicles (EVs), renewable energy storage systems, and consumer electronics, making lithium a critical resource for a sustainable future. The industry’s rapid expansion is a direct response to increasing global efforts to reduce carbon emissions and transition to renewable energy sources.

In 2024, the global demand for lithium mining reached an impressive USD 3,963.1 million, highlighting its pivotal role in the energy sector. As nations invest heavily in electrification and battery technologies, the industry is expected to experience robust growth, with revenues projected to reach USD 4,248.4 million in 2025 and an astounding USD 8,514.8 million by 2035. This equates to a compound annual growth rate (CAGR) of 7.2% during the assessment period (2025-2035), underscoring the sector’s critical importance to the global economy.

Industry Demand Insights

The surge in lithium demand is driven by the EV market, which accounted for over 70% of the global lithium consumption in 2024. With countries such as the United States, China, and members of the European Union pushing for net-zero emissions by mid-century, lithium demand is expected to escalate further. The energy storage market also plays a significant role, as grid-scale storage solutions increasingly rely on lithium-ion technology to manage renewable energy supply.

As lithium reserves remain geographically concentrated, the pressure to explore and develop new deposits has intensified. Governments and private entities alike are ramping up investments in lithium mining to secure their positions in the global supply chain, ensuring a steady flow of this strategic material.

What Are The Factors Hampering The Global Lithium Mining Market?

Adverse Environmental Impacts Associated with Lithium Mining to Hamper the Market

Lithium mining involves mining from rocks and brines. Processing of mine metal is performed by evaporating brine and washing with sodium carbonate in PVC-lined shallow ponds, which is held responsible for water pollution. It also impacts groundwater quality and increases issues associated with water scarcity.

This type of mining also results in dust pollution wherein small Li-particles are suspended in the air. Extended exposure to Li-dust can result in serious respiratory tract disorders. Such factors are anticipated to hamper the market growth in the forthcoming time.

What Are The Prevailing Opportunities In The Global Lithium Mining Market?

Increasing Demand for Lithium in Glass and Ceramic Manufacturing to Offer Remunerative Opportunities to the Lithium Mining Market

Increasing application of lithium compounds such as spodumene and carbonate in glass and ceramics for the manufacturing of enamels and glazes have witnessed growing application to lower firing temperatures and thermal expansion, the growing strength of ceramic bodies and development in viscosity for coating, boosting the glaze’s color, luster, and strength.

The most renowned application of the metal is for the manufacturing of glass-ceramic cooktops, where thermal expansion and thermal resistance are not important. The rising demand for Li-based ceramics and glasses is projected to offer significant opportunities for growth to the market in the forecast period.

Players in the market are taking various initiatives to offer new products in the market during the forecast period. In March 2022, Gogoro, an electric scooter manufacturer, unveiled a prototype lithium ceramic solid-state battery for two-wheel battery swapping.

The prototype has been jointly developed by Gogoro and solid-state battery specialist ProLogium Technology and integrates with Gogoro’s existing vehicles and battery swap network. Attributed to such factors, the lithium mining market is expected to experience various opportunities for growth during the forecast period.

Major Industry Milestones

- Discovery of Global Lithium Reserves Unlocking Future Potential: The identification of untapped lithium reserves in Africa, Asia-Pacific, and South America is reshaping the industry’s landscape. These discoveries are expected to add significant value to the supply chain and alleviate supply constraints.

- Surge in Global Lithium Investments and Strategic Contracts: Companies and governments are entering long-term contracts to secure lithium supplies. In 2024 alone, global lithium investments surpassed USD 2 billion, reflecting a growing commitment to sustainable energy initiatives.

- Ongoing Acquisitions and Expansions Driving Lithium Production Capacity: Major players such as Albemarle, SQM, and Ganfeng Lithium are investing heavily in capacity expansions and acquisitions. These initiatives aim to bolster their market presence and cater to rising demand.

- Environmental and Social Challenges Restraining Growth in the Lithium Mining Industry: Despite its immense potential, the industry faces criticism over water usage, habitat destruction, and social displacements associated with mining operations. These challenges necessitate sustainable practices and community engagement to ensure long-term viability.

“Lithium mining industry is witnessing unprecedented growth fueled by strategic investments and technological advancements. However, addressing environmental and social challenges will be crucial to sustaining this momentum and ensuring long-term profitability,” - says Nikhil Kaitwade, Associate Vice President at Future Market Insights (FMI)

Discover Detailed Findings in the Complete Report! https://www.futuremarketinsights.com/reports/lithium-mining-market

Key Takeaways from Lithium Mining Industry Study

- The global lithium mining market is projected to grow at a CAGR of 7.2% between 2025 and 2035.

- Rising EV adoption is the primary driver of lithium demand.

- Sustainable mining practices are essential to mitigate environmental and social concerns.

- Strategic investments and partnerships are reshaping the competitive landscape.

Competitive Landscape in the Lithium Mining Industry

The lithium mining industry is highly competitive, with key players adopting innovative strategies to maintain their dominance. Collaborative initiatives between mining firms and EV manufacturers are also becoming more prevalent, ensuring a secure supply of lithium to meet future demand.

Leading Lithium Mining Companies

- Sociedad Química y Minera (SQM)

- Albemarle

- Tianqi Lithium

- Ganfeng Lithium

- Pilbara Minerals

- Mineral Resources

- Arcadium Lithium

- Liontown Resources

- Lithium Americas Corp.

- Sichuan Yahua Industrial

Recent Developments

- Albemarle Corporation announced a groundbreaking investment to expand its lithium production facilities in North Carolina by 2025, aiming to enhance its global supply chain.

- SQM signed a strategic partnership with Tesla to supply lithium hydroxide, ensuring the automaker’s long-term battery production needs.

- Argentina’s government approved a millions of investment for lithium exploration projects, aiming to solidify its position as a global lithium supplier.

- Ganfeng Lithium launched a state-of-the-art processing facility in China, designed to boost efficiency and cater to rising global demand for high-purity lithium compounds.

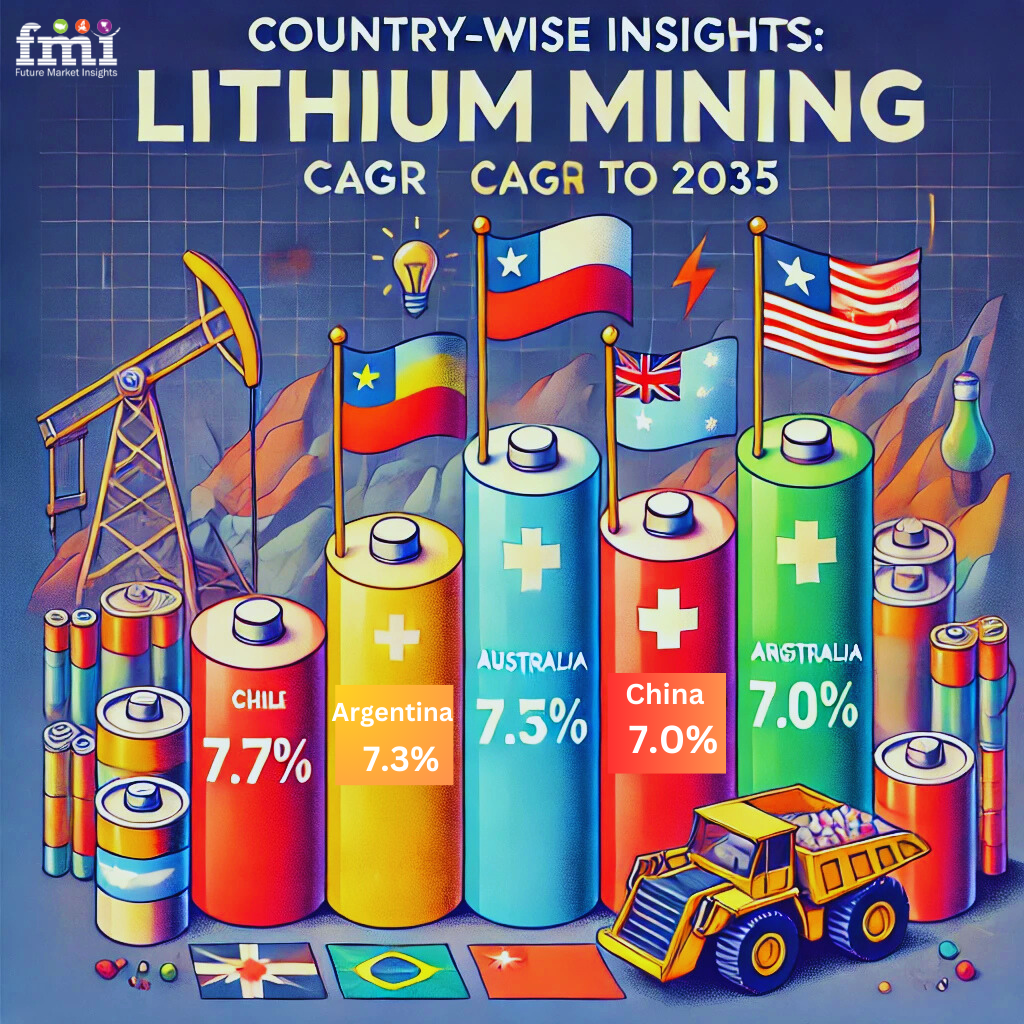

Country-wise Insights

- Australia: The Global Powerhouse of Lithium Production Australia continues to dominate the global lithium supply, accounting for nearly 50% of global production in 2024. The country’s advanced mining infrastructure and robust policies ensure consistent output.

- Chile: Lithium Triangle’s Star with Sustainable Growth As a key player in the "Lithium Triangle," Chile’s sustainable mining practices and abundant reserves make it a vital contributor to global supply chains. The country is focusing on green technologies to enhance production efficiency.

- China: A Silent Titan with Unmatched Lithium Processing Power While China’s lithium reserves are modest, its dominance in lithium processing and battery manufacturing cements its role as a global leader in the value chain. Strategic acquisitions of overseas mining assets further bolster its influence.

- Argentina: The Emerging Lithium Giant of South America Argentina’s untapped lithium reserves and favorable investment policies position it as a rising star in the lithium mining industry. Collaborative efforts between the government and private sector are driving sustainable growth.

Key Segments of Market Report

By Source:

Source included in the study are brine, hard rock, and other resources.

By Product Type:

Product Type included in the study are lithium carbonate, lithium hydroxide, lithium chloride, and other compounds.

By Purity Level:

Purity Level included in the study are battery-grade lithium (≥99.5%), and industrial-grade lithium (<99.5%).

By Mining Method:

Mining method included in the study are open-pit mining, evaporation pond extraction, and direct lithium extraction (DLE).

By Country:

Countries considered in the study include USA, Argentina, Australia, Brazil, Canada, Chile, China, Portugal, Zimbabwe, Canada, and other Countries.

French Translation –

L' industrie minière mondiale du lithium est devenue une pierre angulaire de la transition vers une énergie propre, stimulée par la demande croissante de batteries lithium-ion. Ces batteries alimentent les véhicules électriques (VE), les systèmes de stockage d'énergie renouvelable et l'électronique grand public , faisant du lithium une ressource essentielle pour un avenir durable. L'expansion rapide de l'industrie est une réponse directe aux efforts mondiaux croissants pour réduire les émissions de carbone et assurer la transition vers des sources d'énergie renouvelables.

En 2024, la demande mondiale d'extraction de lithium a atteint le chiffre impressionnant de 3 963,1 millions USD, soulignant son rôle central dans le secteur de l'énergie. Alors que les pays investissent massivement dans l'électrification et les technologies de batteries, l'industrie devrait connaître une croissance robuste, avec des revenus projetés à 4 248,4 millions USD en 2025 et un stupéfiant 8 514,8 millions USD d'ici 2035. Cela équivaut à un taux de croissance annuel composé (TCAC) de 7,2 % au cours de la période d'évaluation (2025-2035), soulignant l'importance cruciale du secteur pour l'économie mondiale.

Informations sur la demande de l'industrie

La forte demande de lithium est alimentée par le marché des véhicules électriques, qui représentait plus de 70 % de la consommation mondiale de lithium en 2024. Alors que des pays comme les États-Unis, la Chine et les membres de l’Union européenne s’efforcent d’atteindre des émissions nettes nulles d’ici le milieu du siècle, la demande de lithium devrait encore augmenter. Le marché du stockage d’énergie joue également un rôle important, car les solutions de stockage à l’échelle du réseau s’appuient de plus en plus sur la technologie lithium-ion pour gérer l’approvisionnement en énergie renouvelable.

Les réserves de lithium étant concentrées géographiquement, la pression pour explorer et développer de nouveaux gisements s’est intensifiée. Les gouvernements et les entités privées intensifient leurs investissements dans l’exploitation du lithium pour sécuriser leurs positions dans la chaîne d’approvisionnement mondiale, garantissant ainsi un flux constant de ce matériau stratégique.

Étapes clés de l'industrie

- La découverte de réserves mondiales de lithium ouvre de nouvelles perspectives : l'identification de réserves de lithium inexploitées en Afrique, en Asie-Pacifique et en Amérique du Sud remodèle le paysage de l'industrie. Ces découvertes devraient ajouter une valeur significative à la chaîne d'approvisionnement et atténuer les contraintes d'approvisionnement.

- Hausse des investissements et des contrats stratégiques dans le lithium à l’échelle mondiale : les entreprises et les gouvernements concluent des contrats à long terme pour garantir leur approvisionnement en lithium. Rien qu’en 2024, les investissements mondiaux dans le lithium ont dépassé les 2 milliards de dollars, ce qui reflète un engagement croissant en faveur des initiatives en faveur des énergies durables.

- Les acquisitions et les expansions en cours stimulent la capacité de production de lithium : des acteurs majeurs tels qu'Albemarle, SQM et Ganfeng Lithium investissent massivement dans des extensions de capacité et des acquisitions. Ces initiatives visent à renforcer leur présence sur le marché et à répondre à la demande croissante.

- Les défis environnementaux et sociaux freinent la croissance de l’industrie minière du lithium : malgré son immense potentiel, l’industrie est critiquée pour son utilisation de l’eau, la destruction de l’habitat et les déplacements sociaux associés aux opérations minières. Ces défis nécessitent des pratiques durables et un engagement communautaire pour assurer la viabilité à long terme.

« L’industrie minière du lithium connaît une croissance sans précédent, alimentée par des investissements stratégiques et des avancées technologiques. Cependant, il sera essentiel de relever les défis environnementaux et sociaux pour maintenir cette dynamique et assurer une rentabilité à long terme », a déclaré Nikhil Kaitwade, vice-président associé chez Future Market Insights (FMI).

Principaux enseignements de l’étude sur l’industrie minière du lithium

- Le marché mondial de l’extraction du lithium devrait croître à un TCAC de 7,2 % entre 2025 et 2035.

- L’adoption croissante des véhicules électriques est le principal moteur de la demande de lithium.

- Les pratiques minières durables sont essentielles pour atténuer les préoccupations environnementales et sociales.

- Les investissements et partenariats stratégiques remodèlent le paysage concurrentiel.

Paysage concurrentiel dans l'industrie minière du lithium

L’industrie minière du lithium est très compétitive, les principaux acteurs adoptant des stratégies innovantes pour maintenir leur domination. Les initiatives de collaboration entre les sociétés minières et les fabricants de véhicules électriques sont également de plus en plus courantes, garantissant un approvisionnement sûr en lithium pour répondre à la demande future.

Principales sociétés minières de lithium

- Société chimique et minière (SQM)

- Albemarle

- Tianqi Lithium

- Ganfeng-Lithium

- Minéraux de Pilbara

- Ressources minérales

- Arcadium Lithium

- Ressources de Liontown

- Lithium Americas Corp.

- Sichuan Yahua Industriel

Développements récents

- Albemarle Corporation a annoncé un investissement révolutionnaire pour agrandir ses installations de production de lithium en Caroline du Nord d'ici 2025, dans le but d'améliorer sa chaîne d'approvisionnement mondiale.

- SQM a signé un partenariat stratégique avec Tesla pour fournir de l'hydroxyde de lithium, garantissant ainsi les besoins de production de batteries à long terme du constructeur automobile.

- Le gouvernement argentin a approuvé un investissement de plusieurs millions de dollars dans des projets d'exploration de lithium, visant à consolider sa position de fournisseur mondial de lithium.

- Ganfeng Lithium a lancé une usine de traitement de pointe en Chine, conçue pour accroître l'efficacité et répondre à la demande mondiale croissante de composés de lithium de haute pureté.

Informations par pays

- Australie : la puissance mondiale de la production de lithium L'Australie continue de dominer l'approvisionnement mondial en lithium, représentant près de 50 % de la production mondiale en 2024. L'infrastructure minière avancée du pays et ses politiques robustes garantissent une production constante.

- Chili : le triangle du lithium, une étoile montante pour une croissance durable En tant qu'acteur clé du « triangle du lithium », les pratiques minières durables du Chili et ses réserves abondantes en font un contributeur essentiel aux chaînes d'approvisionnement mondiales. Le pays se concentre sur les technologies vertes pour améliorer l'efficacité de sa production.

- Chine : un titan silencieux doté d'une puissance de traitement du lithium inégalée Bien que les réserves de lithium de la Chine soient modestes, sa domination dans le traitement du lithium et la fabrication de batteries consolide son rôle de leader mondial dans la chaîne de valeur. Les acquisitions stratégiques d'actifs miniers à l'étranger renforcent encore son influence.

- Argentine : le géant émergent du lithium en Amérique du Sud Les réserves inexploitées de lithium de l'Argentine et ses politiques d'investissement favorables positionnent ce pays comme une étoile montante de l'industrie minière du lithium. Les efforts de collaboration entre le gouvernement et le secteur privé stimulent une croissance durable.

Rapport sur les principaux segments du marché

Par source :

Les sources incluses dans l’étude sont la saumure, la roche dure et d’autres ressources.

Par type de produit :

Les types de produits inclus dans l’étude sont le carbonate de lithium, l’hydroxyde de lithium, le chlorure de lithium et d’autres composés.

Par niveau de pureté :

Les niveaux de pureté inclus dans l’étude sont le lithium de qualité batterie (≥ 99,5 %) et le lithium de qualité industrielle (< 99,5 %).

Par méthode d'extraction :

Les méthodes d’exploitation minière incluses dans l’étude sont l’exploitation à ciel ouvert, l’extraction par bassin d’évaporation et l’extraction directe du lithium (DLE).

Par pays :

Les pays considérés dans l’étude comprennent les États-Unis, l’Argentine, l’Australie, le Brésil, le Canada, le Chili, la Chine, le Portugal, le Zimbabwe, le Canada et d’autres pays.

Authored By

Nikhil Kaitwade (Associate Vice President at Future Market Insights, Inc.) has over a decade of experience in market research and business consulting. He has successfully delivered 1500+ client assignments, predominantly in Automotive, Chemicals, Industrial Equipment, Oil & Gas, and Service industries.

His core competency circles around developing research methodology, creating a unique analysis framework, statistical data models for pricing analysis, competition mapping, and market feasibility analysis. His expertise also extends wide and beyond analysis, advising clients on identifying growth potential in established and niche market segments, investment/divestment decisions, and market entry decision-making.

Nikhil holds an MBA degree in Marketing and IT and a Graduate in Mechanical Engineering. Nikhil has authored several publications and quoted in journals like EMS Now, EPR Magazine, and EE Times.

Have a Look at Related Research Reports of Chemicals & Materials

The global mining lubricant industry size stood at USD 2,255.3 million in 2023. It is further projected to exhibit a Y-O-Y growth of 4.7% in 2024 and reach USD 2,340.5 million in the same year.

In 2024, the global industrial lubricant industry is anticipated to reach USD 26,025.8 million. Demand for the product is predicted to secure a CAGR of 4.8% between 2024 and 2034, reaching USD 41,528.6 million.

The lubricant market is valued at USD 174.94 billion in 2024 and is projected to reach USD 271.68 billion by 2034, exhibiting a modest CAGR of 4.50% over the forecast period.

The increasing need for firearm lubricants with low volatile organic compounds (VOCs) will likely lead to increased demand for weapon lubricants.

The global lubricant additives industry is expected to attain a valuation of USD 13.46 billion in 2023 and is projected to reach USD 21.7 billion by 2033.

The worldwide lithium and lithium ion battery electrolyte market size is expected to reach USD 5,281.6 million in 2024. The sector’s progress is expected to be at a CAGR of 12.2% from 2024 to 2034.

The lithium compound market is anticipated to be worth USD 11.8 billion in 2024. The market is expected to grow at an astounding rate from 2024 to 2034, with a CAGR of 21.3%.

The global lithium ion battery separator market is expected to secure USD 3,256.7 Million in 2032 while expanding at a CAGR of 7.2%. The market is likely to hold a value of USD 1,624.9 Million in 2022.

The global mining flotation chemicals market is currently valued at USD 11,885.5 million in 2023 and is anticipated to progress at a healthy CAGR of 5% to reach USD 19,360.2 million by 2033.

The global mining collectors market is anticipated to reach a value of over USD 10,681.1 Million by the end of 2027 while registering a CAGR of 5.8% between 2018 and 2027.

Checkout our recent article on Global Benzene Sales Forecast from 2024 to 2034

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

Distribution channels: Book Publishing Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release