Gold’n Futures Prepares for 2021 Drilling Season and Announces Private Placement of Units and Flow Through Shares

/EIN News/ -- VANCOUVER, British Columbia, April 15, 2021 (GLOBE NEWSWIRE) -- GOLD’N FUTURES MINERAL CORP. (CSE: FUTR) (FSE: G6M), (OTC: GFTRF) (the "Company” or “Gold’n Futures”) is pleased to report its progress and plans for the 2021 exploration and drilling season on the Hercules project in the Greenstone gold camp in northern Ontario, Canada (the “Hercules Project”).

As stated in the Company’s news release of March 24, 2021, the Company has commenced its work on the Hercules Project, beginning with the geological and geophysical modeling of the known gold zones and across the property. The Gold’n Futures team has obtained the substantial database containing the Hercules Project’s technical information and has taken steps in preparing its initial analyses. Much of the historical work completed on the Hercules Project has been summarized in the National Instrument 43-101 report titled, “A TECHNICAL REVIEW AND MINERAL RESOURCE ESTIMATE OF THE HERCULES PROPERTY, ELMHIRST AND RICKABY TOWNSHIPS, ONTARIO, CANADA FOR KODIAK EXPLORATION LIMITED”, prepared by Watts, Griffis and McQuat Limited ("WGM") and dated May 26, 2010 (the “WGM Report”). The WGM Report derived its resource estimation from a database comprised of 407 drillholes totalling 90,300 metres (“m”) and 173 trenches. The resource estimate defined in the WGM report is historical in nature and should not be viewed as a current resource estimate.

Relevant data not included in the WGM Report are:

- Pre-2005 historical drilling and trenching samples completed prior to the work of Kodiak Exploration Limited ("Kodiak") where locations of the hole collars and surface samples may have been uncertain; and,

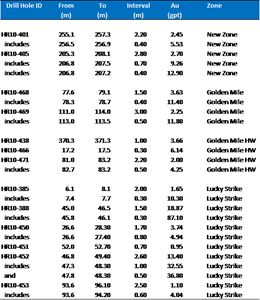

- The sample results from 90 additional drill holes completed after the WGM Report was authored, totaled 15,580.7 m of core and with 7,946 samples taken. Table 1, shown below, contains some of the notable intersections of these later 90 holes.

The Company strongly believes that the above noted missing data, which amounts to about 20 - 25% of all Hercules Project exploration, could lead to an underestimation in the WGM Report as it relates to the potential resources of the Hercules Project. With much of the claims’ group still to be properly explored, Gold’n Futures’ exploration team is looking to make full use of all available results of the early exploration, coupled with the 2010 – 90 drill holes to vector to priority targets.

Stephen Wilkinson, Gold’n Futures’ CEO, commented, “I am most confident in the Company’s team, headed up by P. Geo. Walter Hanych. Walter has provided valuable resource experience to our management team and he has been instrumental in exploration planning and data reorganization that will drive our next steps in opening up the potential of the Hercules Project. We believe that much can be added to the current gold resource models from expansion of the known gold occurrences and by following up on the new targets we are generating by incorporating past assessment files data. The team of geophysicists that we have engaged is working on the compilation of all past geophysical surveys and is coordinating with our geologists. The objective is to create a coordinated interpretation of the controlling mineral structures that in turn will vector our target selection.”

2021 Hercules Exploration Plans

The Company has commissioned a National Instrument 43-101 report, which will summarize the historical work performed on the Hercules Project, listed above. The Company is currently compiling and tabling the historical data in preparation for constructing a current resource block model. Structural and geological modelling of the gold zones together with the completed geophysical interpretation will be an integral component of this compilation to identify domains of gold mineralization. An early and high priority objective for the desktop work will be the locating of areas for follow-up trenching and drill collar sites so the Company will begin the permitting of its next round of property activities.

The initial on-site work will begin immediately upon the completion of spring break-up. The Company will undertake a program of core re-sampling as past sampling intervals were not consistently extended to the shoulders of a sample or sample intervals. Sampling will be commenced to infill and to expand the surface areas of the gold zones in existing trenches and outcrops. Where drill technical data is wanting, surveyors will locate drill collars and down hole surveys will be done with equipment not influenced by the highly magnetic character of the host rocks.

It is expected that some results of this early work will be available for release beginning within the next few weeks and the Company will keep its stakeholders fully apprised of its progress and findings. Once our planning has advanced and permit obtained, Gold’n Futures will commence its first diamond drill program for which we are anticipating an initial round in the order of 10,000m.

Qualified Person

The scientific and technical content of this press release has been prepared, reviewed and approved by Mr. Walter Hanych, P. Geo., who is a Qualified Person under NI 43-101 regulations and is a director of the Company.

Private Placements

Gold’n Futures also announces it has arranged private placement financings for working capital and exploration funds.

Gold’n Futures intends to complete a non-brokered private placement financing (the "Offering") for gross proceeds up to $6,000,000. Pursuant to the Offering, the Company intends to issue: (a) up to 13,333,333 ("Hard Units"), at a price of $0.15 per Hard Unit, for aggregate gross proceeds of up to $2,000,000; and (b) up to 20,000,000 "flow-through" shares ("FT Shares"), at a price of $0.20 per FT Share, for aggregate gross proceeds of $4,000,000. The proceeds from the sale of FT Shares will be used for Canadian Exploration Expenses (within the meaning of the Income Tax Act (Canada)) and will be renounced for the current taxation year.

Each Hard Unit will consist of one common share in the capital of the Company and one common share purchase warrant (each common share purchase warrant, a "Hard Unit Warrant"), with each Hard Unit Warrant being exercisable to acquire one common share of the Company at a price of $0.25 for a period of 36 months following the closing date of the Offering.

Completion of the Offering is subject to approval of the Canadian Securities Exchange and other requisite approvals. All of the securities issuable in connection with the Offering will be subject to a hold period expiring four months and one day after date of issuance.

A finder's fee in shares, cash, warrants or a combination of all may be payable in connection with this placement which will not exceed the maximum allowable under the policies of the CSE.

About Gold’n Futures Mineral Corp.

Gold’n Futures Mineral Corp. (CSE: FUTR) (FSE: G6M) (OTC: GFTRF) is a Canadian based exploration company focused on advancing its Hercules gold project located in the Hercules-Elmhurst property. The Hercules Project is located 120 kilometres northeast of Thunder Bay, Ont., in the townships of Elmhurst and Rickaby, within the Thunder Bay North Mining District in the heart of the Beardmore – Geraldton gold mining camp. The property lies within an Archean greenstone belt that extends from the Longlac area in the east to Lake Nipigon in the west, a distance of about 130 kilometres. The property consists of 372 contiguous claim cells (6,951 hectares). To date, the work completed on the property forms an extensive database including reconnaissance grab samples; channel samples; a variety of geophysical surveys; and, a drill hole database that includes historical drilling totalling in the order of 537 holes. More than a total of 2,000 grab and channel samples were collected from the property. In the last two field seasons, more than 150,000 square metres of trenches were developed much of which have been fully reclaimed. For more information, please visit our website at: www.goldnfuturesmineralcorp.com

On behalf of the Board of Directors

For further information

Stephen Wilkinson,

President and CEO

Matt Fish, Director and Treasurer

Phone: 905 781-8786

www.goldnfuturesmineralcorp.com

The Canadian Securities Exchange accepts no responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements based on assumptions and judgments of management regarding future events or results. Such statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking statements. There is no assurance the private placement, property option, change of board or reinstatement of trading referred to above will close on the terms as stated, or at all. The Company disclaims any intention or obligation to revise or update such statements.

A graphic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1f49fad0-45dc-460f-bdb5-f82462b198ef

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.