ASX Small Caps Lunch Wrap: Which US politicians have clearly had a brainfart this week?

News

News

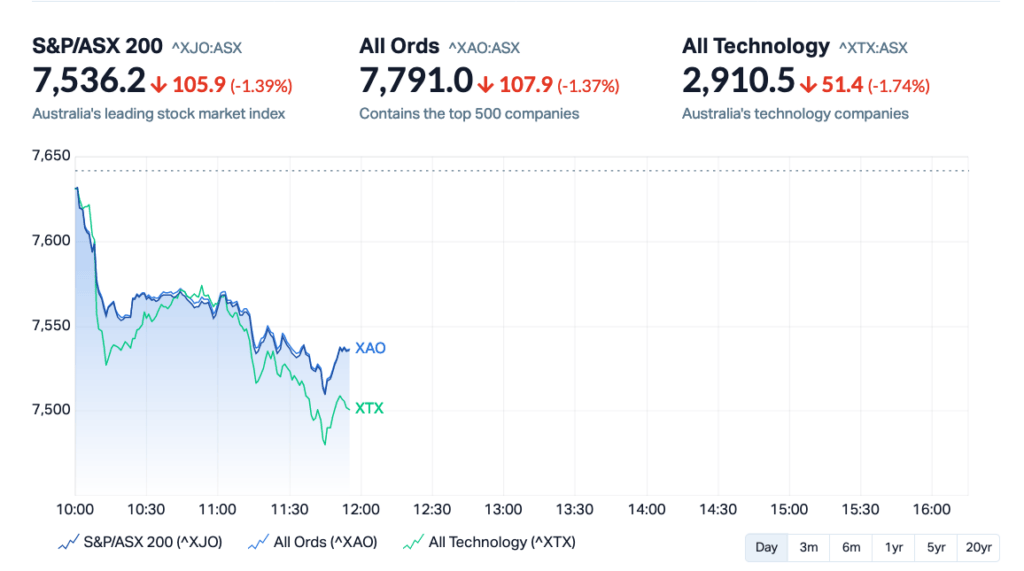

Local markets are performing poorly this morning, turning up for work like they’re meant to but sinking like a stone the moment the doors opened for business at 10:00am.

As we roll towards lunch, the benchmark is already down more than -1.3% and still trending lower, so buckle up… this could very well be a Friday to forget.

I’ll get into the reasons why that might be happening shortly, but first a quick dive into the unending parade of murk that is US politics, because a group of conservative representatives have kicked a bit of an own goal in naming a legislative hit squad from their own ranks.

A quick refresher for those of you who don’t follow American politics. On the conservative side of the aisle, some conservatives are more conservative than others.

(I’m trying very hard to be polite, because the reality is, the further in that direction you go, the nuttier the chocolate tends to get.)

They call themselves the House Freedom Caucus, and it’s a who’s who of the more ‘strident’ US representatives, including the inimitable Marjorie Taylor Greene, whose greatest hits include blaming “Jewish space lasers” for a series of deadly bushfires in California, and Lauren Boebert, who most recently received a lot of press coverage for giving a male companion a “helping hand” in a packed theatre.

Anyhoo… they’re currently fighting a war within their own party, and feel the need to be extra-vigilant, to ensure that several deals they put in place with former House Speaker Kevin McCarthy remain unmolested.

The main prong of that vigilance is the formation of an “action group”, which exists to ensure that someone from their group is keeping an eye on what’s happening on the floor of the House at all times.

They’ve named it the Floor Action Response Team – and, given the state of US politics at the moment and the general ‘loose cannon’ tone of that particular group, it’s impossible to tell if they’ve missed the import of the resulting acronym out of sheer stupidity, or if it’s a tongue-in-cheek gag at their own expense.

Either way, US conservatives can rest easy at night, knowing that the crack team from FART is keeping watch, protecting conservative interests from those baby-eating Democrats, and the real enemy at the gates: other Republicans.

There’s a lot happening around the world this morning, so bear with me because it’s been something of a distraction, and left me a bit behind the eightball in terms of time today.

Local markets started with a solid dip from the outset, which left every market sector down and the benchmark more than -1.0% in the red very early in the session, with the bulk of the market continuing to trend lower.

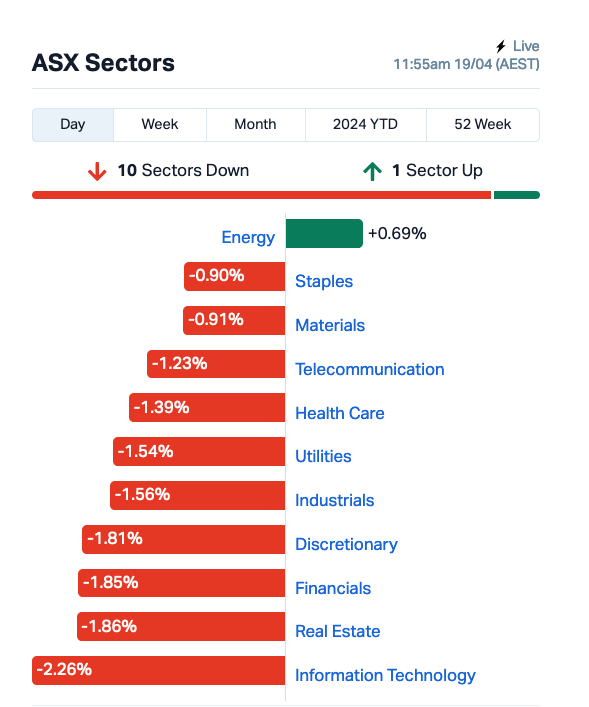

Since then, one market sector has lifted into positive territory, after the Energy sector got a huge shot in the arm around 11:00am, and it has continued to climb since then, and this is what things were looking like around midday.

The spike for the Energy sector is highly likely to be the result of a major escalation in hostilities in the Middle East, which has caused a rapid spike in oil prices, after news broke that Israel had launched a series of attacks against its neighbours.

At the time of writing, Brent Crude is up 4.29%, WTI is up +3.89% – and those numbers are continuing to tick higher as I’m watching them.

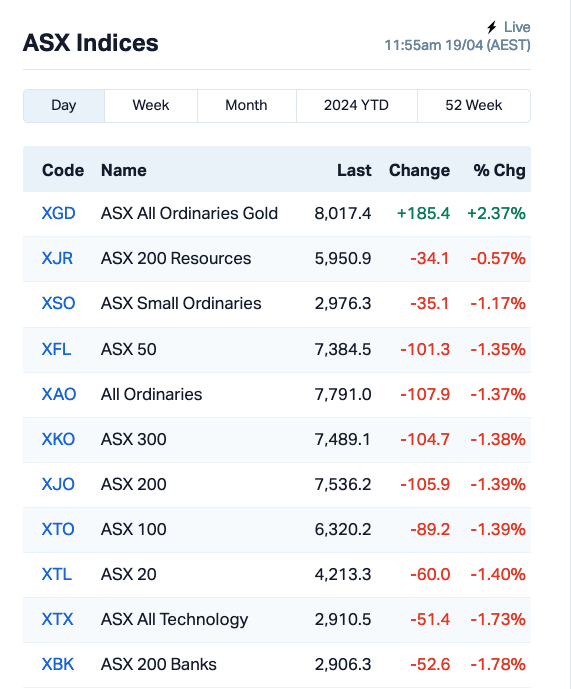

The only other slice of the market that’s doing well this morning are, predictably, the goldies – the XGD All Ords Gold index was pointing +2.4% higher at midday – and by 1:00pm, it was more than +3.0% higher.

There aren’t any major wins among the Large Caps this morning, but financial services mob Pinnacle is reporting a sharp drop this morning, down -5.39% for the morning so far.

Things were grim in the US overnight as well, after a mixed session that left the S&P 500 down by -0.22%, its fifth straight day of declines.

The blue chips Dow Jones index was up slightly by +0.06%, but the tech-heavy Nasdaq slipped by -0.52%.

US investors hanging out for a rate cut were dealt yet another blow, as fresh unemployment data showed that the number of Americans filing new claims for unemployment benefits was unchanged last week from the week before, pointing to continued labour market strength.

“A strong labour market gives the Federal Reserve the room to put off rate cuts until inflation gets back on a sustainable path to 2%,” explained Nancy Vanden Houten at Oxford Economics – a sentiment backed by comments from New York Fed president John Williams who said that he doesn’t see any “urgency” to cut interest rates.

However – jumping briefly back into local news for a moment – Former Reserve Bank of Australia assistant governor, Luci Ellis, has pointed out that the outlook for a rate cut here in Oz is probably not quite so grim, suggesting that conditions that would lead the RBA to call a cut could line up locally faster than they’re likely to in the US.

In US stock news, Netflix reported Q1 earnings after the bell that showed more subscriber growth than expected, but a slightly lower revenue guidance. Netflix’s shares slipped almost -5%.

Taiwan Semiconductor Manufacturing Company (TSMC), the chipmaker for Nvidia, also fell -5% after it reported Q1 results above estimates, but lowered its overall projections for semiconductor revenue.

The good news is TSMC also confirmed plans to spend up to US$32bn this year, reassuring investors who are concerned that AI demand is already at peak levels.

Meanwhile, Meta shares climbed +1.5%, while Tesla continued its woeful year, down another -3.5% despite efforts to streamline the business that will see up to 15,000 people lose their jobs, to take its YTD loss to just under -40%.

Asian markets are mixed, with the Hang Seng and Nikkei a long way down, -1.4% and -3.31% respectively, while Shanghai is being very ‘Shanghai’ given the global conditions, rising gently by +0.08% like it doesn’t have a care in the world.

Here are the best performing ASX small cap stocks for 19 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

CODE COMPANY PRICE % TODAY VOLUME MARKET CAP DY6 Dy6Metalsltd 0.057 54% 1,153,294 $1,495,201 BLZ Blaze Minerals Ltd 0.006 50% 2,508,163 $2,514,233 JAV Javelin Minerals Ltd 0.002 33% 4,524 $3,264,346 RIL Redivium Limited 0.004 33% 125,000 $8,192,564 MAUCA Magnetic Resources - Ctg Nil Pd, 20C Unpd 0.795 30% 6,251 $12,455,506 AI1 Adisyn Ltd 0.026 30% 403,371 $3,526,992 CYM Cyprium Metals Ltd 0.031 29% 10,412,712 $36,593,096 MCT Metalicity Limited 0.0025 25% 7,560,694 $8,970,108 TX3 Trinex Minerals Ltd 0.005 25% 699,780 $6,979,637 PPY Papyrus Australia 0.011 22% 15,233 $4,434,233 AU1 The Agency Group Aus 0.03 20% 214,382 $10,714,415 8IH 8I Holdings Ltd 0.012 20% 8,416 $3,573,560 ADD Adavale Resource Ltd 0.006 20% 83,164 $5,079,898 ATH Alterity Therap Ltd 0.006 20% 5,018,631 $26,190,089 HLX Helix Resources 0.006 20% 2,377,494 $11,615,729 NRZ Neurizer Ltd 0.006 20% 4,995,988 $7,507,054 RML Resolution Minerals 0.003 20% 428,880 $4,024,992 VEN Vintage Energy 0.012 20% 3,964,774 $10,869,403 LYN Lycaonresources 0.34 19% 935,091 $12,556,032 X2M X2M Connect Limited 0.051 19% 130,934 $11,468,845 ALM Alma Metals Ltd 0.01 18% 1,231,264 $11,141,913 FTL Firetail Resources 0.04 18% 195,303 $5,062,789 MRZ Mont Royal Resources 0.07 17% 189,358 $5,101,788 LNR Lanthanein Resources 0.0035 17% 201,000 $5,864,727 CUF Cufe Ltd 0.015 15% 3,301,034 $14,899,461

DY6 Metals (ASX:DY6) was out in front on Friday morning, after the company revealed news of rock chips grading up to 3.22% TREO at the newly granted Machinga licence.

The results came from a soil sample survey, which collected 305 soil samples on a 200m x 100m grid, and total assays from that endeavour returned up to 0.49% TREO, with 21% of all soil samples returning >1000ppm (>0.1%) TREO.

Adisyn (ASX:AI1) was also tracking well this morning, with the defence sector IT company top of mind for many investors, thanks to the investor prezzo the company dropped on Monday.

Cyprium Metals (ASX:CYM) was rising steadily, as the copper focused company welcomes an experienced new board appointment, Scott Perry, as a non-executive director and chair of the Audit Committee.

And gold explorer Metalicity (ASX:MCT) was climbing this morning, announcing that drilling is set to commence at its Yundamindra project – the first drilling activity there in 10 years.

However, Metalicity’s rise this morning was most likely due to investors being reminded that historical exploration at the site returned assays including 8m @ 56.36g/t Au from 44m, which the company announced back in 2019.

Here are the most-worst performing ASX small cap stocks for 19 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap TNY Tinybeans Group Ltd 0.051 -46% 800 $7,918,064 GTG Genetic Technologies 0.13 -26% 297,779 $20,198,018 AXP AXP Energy Ltd 0.0015 -25% 644,195 $11,649,361 FAU First Au Ltd 0.0015 -25% 630,000 $3,323,987 MRD Mount Ridley Mines 0.0015 -25% 1,354,388 $15,569,766 1TT Thrive Tribe Tech 0.016 -20% 18,951 $5,932,430 AVE Avecho Biotech Ltd 0.004 -20% 3,220,390 $15,846,485 TNC True North Copper 0.086 -18% 3,860,899 $43,859,503 PGM Platina Resources 0.025 -17% 1,036,834 $18,695,410 AL8 Alderan Resource Ltd 0.005 -17% 9,676,082 $6,641,168 NVU Nanoveu Limited 0.02 -17% 991,932 $10,696,695 RR1 Reach Resources Ltd 0.0025 -17% 325,000 $11,070,061 SRT Strata Investment 0.14 -15% 15,000 $27,954,890 GRV Greenvale Energy Ltd 0.064 -15% 272,407 $33,015,778 DAL Dalaroometalsltd 0.018 -14% 551,657 $1,737,750 AEV Avenira Limited 0.006 -14% 1,398,844 $16,443,238 OSL Oncosil Medical 0.006 -14% 1,283,334 $15,788,788 RMI Resource Mining Corp 0.02 -13% 283,694 $13,624,000 1MC Morella Corporation 0.0035 -13% 315,912 $24,715,198 FGL Frugl Group Limited 0.007 -13% 110,891 $11,918,197 RNE Renu Energy Ltd 0.007 -13% 231,788 $5,533,072 RAS Ragusa Minerals Ltd 0.022 -12% 90,909 $3,564,970 CHM Chimeric Therapeutic 0.03 -12% 5,166,886 $28,960,901 PLL Piedmont Lithium Inc 0.19 -12% 7,194,249 $82,523,988 BCK Brockman Mining Ltd 0.023 -12% 73,935 $241,286,035

Drilling is now underway at Impact Minerals’ (ASX:IPT) Hyperion rare earth element (REE) prospect to test a large, +1000ppm TREO soil geochemistry anomaly.

The soil anomaly of at least 3km2 includes REE anomalism of up to 5,800ppm total rare earth oxides including high value neodymium and praseodymium of up to 21% within a 3km2 area.

Hyperion is a potential clay-hosted deposit hosted in weathered granite and will be tested by 40 aircore holes.

Renascor Resources (ASX:RNU) has executed the native title agreement with the Barngarla Determination Aboriginal Corporation, which paves the way to advance to the construction and operation phases of its Siviour graphite project in South Australia.

It follows the company securing a $185m loan facility from Australia’s Critical Minerals Facility scheme to fast-track development and operation of the upstream graphite concentrate operation at the project.

Besides allowing the company to construct and operate the proposed mine, the agreement also allows RNU to proceed with its planned construction and operation of a desalination plant to support mining operations.

Additionally, the agreement provides pathways for employment, training and contracting of members of the Barngarla people and for cultural awareness and communication.

At Stockhead, we tell it like it is. While Impact Minerals and Renascor Resources are Stockhead advertiser, they did not sponsor this article.